Form 50-132. Property Owner’s Notice of Protest

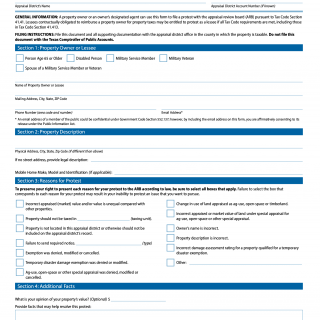

The Property Owner's Notice of Protest, also known as Form 50-132, is a legal document specific to Texas counties with populations greater than 120,000. The main purpose of this form is to allow property owners to protest the appraised value of their property, which is used to calculate property taxes.

This form consists of several important parts, including the owner's information, the property's location and description, the reason for the protest, and the desired value of the property. It is important to provide accurate and detailed information in all of these fields when filling out the form.

When filling out the form, property owners will need to provide supporting documentation to substantiate their claim, such as recent sales data of comparable properties or a professional appraisal report. This additional documentation will help to support the owner's case and increase their likelihood of success.

Application examples of this form include if the property owner believes their property has been overvalued, or if there have been changes to the property's condition that were not taken into account during the assessment process.

Strengths of this form include providing a formal and organized means of protesting property value assessments. A weakness may include the potential for errors or omissions in the information provided, leading to delays or denial of the protest.

Alternative forms that may be used include informal methods such as contacting the appraisal district directly or hiring a property tax consultant to assist with the protest process.

The Property Owner's Notice of Protest can affect the future of the participants by potentially lowering their property taxes. Once submitted, the form is typically stored in the appropriate appraisal district office records for future reference.

In summary, the Property Owner's Notice of Protest is an important tool for property owners seeking to dispute the assessed value of their property and reduce their property taxes in Texas counties with populations greater than 120,000.