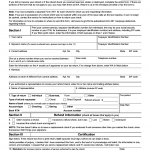

CMS-1500 Health Insurance Claim Form (HCFA)

The CMS-1500 Health Insurance Claim Form is a standard form used by healthcare providers to submit claims for payment to insurance companies.

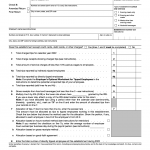

IRS Form 8888. Allocation of Refund

IRS Form 8888, also known as "Allocation of Refund (Including Savings Bond Purchases)," is a form that allows taxpayers to divide their federal tax refund into multiple accounts or to use a portion of it to buy U.S. savings bonds.

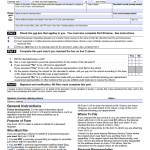

IRS Forms That Can Help Lower Your Tax Bill

Whether you're a business owner, self-employed individual, or a regular taxpayer, these forms - if used correctly - can potentially save you thousands of dollars in taxes each year.

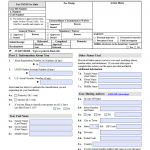

IRS Form 3911. Taxpayer Statement Regarding Refund

IRS Form 3911, Taxpayer Statement Regarding Refund, is a form that taxpayers can use to inquire about the status of their refund or request a replacement for a lost, stolen, or destroyed refund check.

IRS Form 4506. Request for Copy of Tax Return

IRS Form 4506, Request for Copy of Tax Return, is a form used by taxpayers to request a copy of their previously filed tax return.

IRS Form 8027. Employer's Annual Information Return of Tip Income and Allocated Tips

IRS Form 8027, also known as Employer's Annual Information Return of Tip Income and Allocated Tips, is a tax form used by employers who operate large food or beverage establishments where tipping is customary.

IRS Form W-4P. Withholding Certificate for Periodic Pension or Annuity Payments

IRS Form W-4P, also known as Withholding Certificate for Periodic Pension or Annuity Payments, is a form used by pension or annuity recipients to inform their payer how much federal income tax should be withheld from their periodic payments.

Form I-129F. Petition for Alien Fiancé(e)

Form I-129F, also known as Petition for Alien Fiancé(e), is a form used by U.S. citizens to petition for their foreign national fiancé(e) to enter the United States and get married. The main purpose of this form is to allow U.S.

IRS Form 1310. Statement of Person Claiming Refund Due a Deceased Taxpayer

Form 1310 is a form used by taxpayers to claim a refund of taxes for a deceased individual.

CBP Form I-94. Arrival/Departure Record, for documenting foreign visitors' arrivals and departures from the United States

If you are traveling to the United States as a non-immigrant, you will be required to fill out the CBP Form I-94, also known as the Arrival/Departure Record. This form is used by the U.S. Customs and Border Protection (CBP) to document your arrival and departure from the U.S.