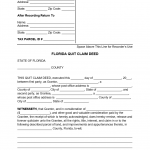

Quit Claim Deed Form (Florida)

The Quit Claim Deed form is a legal document used in the state of Florida to transfer ownership of real estate from one party to another. The form is mainly used when the property transfer is between family members or when the property is held in a trust.

Request for Quotation (RFQ)

A Request for Quotation (RFQ) is a document used to solicit bids from vendors or suppliers. It is typically used to obtain formal price and/or quality quotations for goods or services, and to compare them.

Request for Documentation

A Request for Documentation form is a formal request made by an individual or organization to another party to provide specific documents or information.

Request for Applications

A Request for Applications (RFA) is a type of solicitation document that is used to invite organizations, institutions, and individuals to submit proposals for funding.

Request for Expressions of Interest (REOI)

The Request for Expressions of Interest (REOI) form is a document used to request preliminary indications of interest from potential suppliers or service providers for a particular project or opportunity.

Expression of Interest

The Expression of Interest (EOI) form is a document used to express an interest in a particular opportunity or project.

Confirmation of Call Letter

A Confirmation of Call letter is a formal document that serves as a written record of a phone conversation between two parties.

Confirmation of Attendance letter

A Confirmation of Attendance letter is a formal document that confirms an individual's attendance at an event, meeting, or appointment. It serves as a record of attendance and can be used for various purposes, such as tracking attendance for payroll or attendance records.

Agreement termination letter

An Agreement Termination Letter is a legal document used to formally end a contract or agreement between two or more parties. It serves as a written record of the termination and outlines the terms and conditions for the termination of the agreement.

Relieving Letter

A relieving letter is a document that is issued by an employer to an employee who is resigning or leaving the company. Its main purpose is to formally acknowledge the employee's resignation and to state that the employee has completed all of their duties and responsibilities.