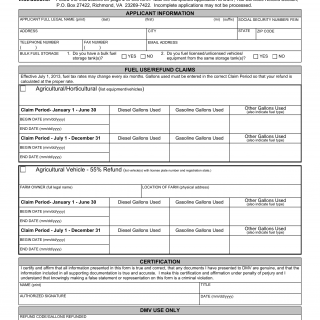

Form TS 216A. Agriculture and Horticulture Fuels Tax Refund Application - Virginia

Form TS 216A - Agriculture and Horticulture Fuels Tax Refund Application is a specialized version of Form TS 216. It is used specifically to apply for a refund of the Virginia Fuels Tax on fuel purchases used for agriculture or horticulture purposes.

The parties involved include individuals or entities engaged in agriculture or horticulture activities, and the Virginia Department of Motor Vehicles. The form contains sections detailing fuel purchase details, tax payment, and refund request.

Key fields include fuel purchase information, tax payment specifics, refund amount, and applicant signature. Accurate information and clear eligibility for agriculture or horticulture use are important for successful refund application.

For instance, a farmer or horticulturist who uses fuel for equipment related to their agricultural or horticultural activities would complete this form to request a refund of the Virginia Fuels Tax for eligible purchases.

No direct related forms are mentioned, but an alternative could involve forms for similar tax refund applications related to specific industries or activities.