Letter of Regret

A Letter of Regret is a written communication that expresses disappointment or apologies for an inability to fulfill a request or meet an expectation. The purpose of this form is to provide a formal and polite response to a request that cannot be granted or an offer that cannot be accepted.

IRS Form SS-4. Application for Employer Identification Number (EIN)

Form SS-4 is an application for an Employer Identification Number (EIN) used to identify a business entity for tax purposes. The form consists of several parts, including general information about the business, the reason for applying, and the type of entity.

Form 5500. Annual Return/Report of Employee Benefit Plan

Form 5500, also known as the Annual Return/Report of Employee Benefit Plan, is a form that is used to report information about employee benefit plans to the Department of Labor, the IRS, and the Pension Benefit Guaranty Corporation.

IRS Form 8594. Asset Acquisition Statement Under Section 1060

Form 8594, also known as the Asset Acquisition Statement Under Section 1060, is an IRS form that is used to report the sale of a business.

IRS Form 720. Quarterly Federal Excise Tax Return

Form 720 is a Quarterly Federal Excise Tax Return that is used to report and pay excise taxes on certain goods and services.

DV-400. Findings and Order to Terminate Restraining Order After Hearing

DV-400, Findings and Order to Terminate Restraining Order After Hearing, is a legal form used in California to request the termination of a restraining order after a hearing. The main purpose of this form is to formally terminate a restraining order that was previously issued by the court.

IRS Form 990. Return of Organization Exempt from Income Tax

Form 990, Return of Organization Exempt from Income Tax, is a tax form used by tax-exempt organizations in the United States to report their financial activities to the Internal Revenue Service (IRS).

NAVPERS Form 1306/7. Electronic Personnel Action Request

NAVPERS form 1306/7 is a document used by the United States Navy to request a change in a service member's duty station. The main purpose of this form is to facilitate the transfer of Navy personnel from one duty station to another.

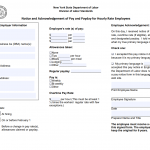

Form LS 54. Notice and Acknowledgement of Pay and Payday for Hourly Rate Employees

The LS 54 Form is a notice and acknowledgement form required by the New York State Department of Labor's Division of Labor Standards. The purpose of the form is to notify hourly rate employees of their pay rate and payday and to obtain their acknowledgement of this information.

UB-04 Claim Form (CMS-1450)

The UB-04 Claim Form, also known as the CMS-1450 form, is a standard form used by healthcare providers to submit claims for payment to Medicare and Medicaid. It is also used by some private insurance companies.