NYS DMV Form UT-11C. County Use Tax Exemption Certificate

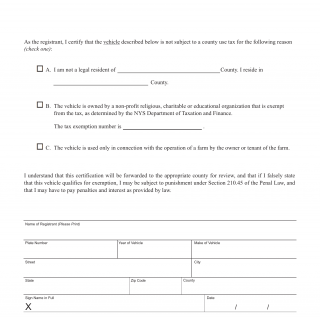

The NYS DMV Form UT-11C is a certificate used to claim exemption from local county auto use taxes outside of New York City. It should be noted that this form cannot be used to claim exemption from the auto use tax imposed by New York City. For exemption within NYC, individuals should obtain form UT-11 from their local DMV Office or Call Center.

This form is typically used when purchasing a vehicle in a county outside of New York City but registering it within the state. It allows individuals to declare their eligibility for an exemption from the county use tax, which is a tax imposed on the use of a vehicle in certain counties.

When filling out this form, important fields to consider include the individual's name, address, and contact information, as well as details about the vehicle being registered. Additionally, supporting documentation, such as proof of residency or proof of payment of sales tax, may be required to accompany the form.

It is important to note that the requirements for claiming exemption from county use taxes may vary depending on the specific county and its regulations. Therefore, individuals should consult the instructions provided with the form and contact their local DMV office for any additional guidance or clarification.

Alternative forms that may be relevant include the NYS DMV Form DTF-803, which is used to claim exemption from sales and use taxes on a vehicle purchased outside of New York State, and the NYS DMV Form DTF-804, which is used to claim exemption from sales and use taxes on a vehicle purchased by a nonresident of New York State. These forms serve similar purposes but are specific to different tax exemptions and eligibility criteria.