VA Form 119. Report of Contact

The VA Form 119, also known as the Report of Contact, is a vital document used by the Department of Veterans Affairs (VA) to record important information about interactions or communications with veterans or their representatives.

Form TR-205. Ownership Certification

The TR-205 Ownership Certification form is a document issued by the Michigan Department of State that serves as a last resort for individuals who have lost, destroyed, or had their vehicle, watercraft, snowmobile, non-titled watercraft, or moped registration stolen and are unable to contact the p

Form TR-207. Bill of Sale

The TR-207 Bill of Sale is a legal document that serves as evidence of the transfer of ownership of a vehicle from one party to another in Michigan.

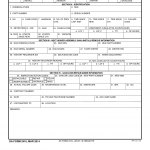

VA Form 10-2850C. Application for Associated Health Occupations

The VA Form 10-2850C, Application for Associated Health Occupations, is a form used by individuals seeking employment in associated health occupations within the Department of Veterans Affairs (VA).

VA Form 10-8678. Application for Annual Clothing Allowance

The VA Form 10-8678, Application for Annual Clothing Allowance, is a form used by eligible veterans to apply for a yearly allowance to purchase clothing that accommodates their disabilities or medical conditions.

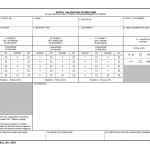

DA Form 7821. Pistol Validation Scorecard

The DA Form 7821 is the Pistol Validation Scorecard used by the United States Army for evaluating the marksmanship skills of soldiers with a pistol.

DA Forms 7453 - 7594

The United States Army utilizes various forms to record and manage data related to its operations.

DA Forms 2106 - 2453

The United States Army uses a variety of forms to ensure its operations run smoothly and efficiently. These forms are used for various purposes, such as documenting personnel information, reporting property loss or damage, and requesting additional training.

DA Form 2410. Component Removal/Repair/Install/Gain/Loss Record

DA Form 2410 is a record-keeping form used by the U.S. Army for documenting component removal, repair, installation, gain, and loss. The purpose of this form is to maintain a history of maintenance and repairs performed on military equipment, such as vehicles and weapons systems.