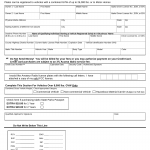

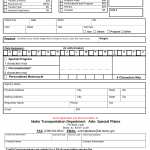

Form ITD 3427. Radio Amateur Plates

Form ITD 3427 is used in Idaho for individuals who are licensed radio amateurs and wish to obtain special license plates that represent their amateur radio call sign on their vehicle.

Form ITD 3425. Personalized Plates

Form ITD 3425 is used in Idaho for individuals who wish to apply for personalized license plates for their vehicles.

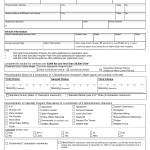

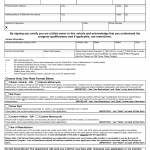

Form ITD 3415. Vehicle Consignment With a Licensed Idaho Dealer

Form ITD 3415 is used in Idaho when an individual consigns their vehicle with a licensed Idaho dealer for the purpose of selling it on their behalf. The main purpose of this form is to establish a consignment agreement and facilitate the legal transfer of ownership of the vehicle.

Form ITD 3204. Titles Transmittal For Dealer/Financial Agency

Form ITD 3204 is used by motor vehicle dealers or financial agencies in Idaho to transmit title applications to the Idaho Department of Motor Vehicles (DMV) for regular processing.

Form ITD 3203. Titles Transmittal For Dealer/Financial Agency, RUSHES ONLY

Form ITD 3203 is used by motor vehicle dealers or financial agencies in Idaho to transmit title applications to the Idaho Department of Motor Vehicles (DMV) for rush processing. The main purpose of this form is to expedite the processing of title requests for urgent situations.

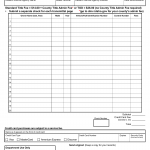

Form ITD 3635. Application for Dealer Plate

Form ITD 3635 is used in Idaho by individuals or entities engaged in the business of buying, selling, or dealing in vehicles to apply for dealer plates.

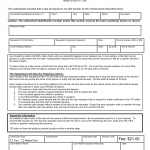

Form ITD 3670. Exempt License Plates

Form ITD 3670 is used in Idaho by individuals or entities who are eligible for exempt license plates. The main purpose of this form is to apply for license plates that provide exemptions from certain vehicle registration fees and requirements.

Form ITD 3675. Special Plates for Special Vehicles

Form ITD 3675 is used in Idaho by individuals or entities who wish to obtain special license plates for vehicles that qualify under certain categories, such as collector vehicles, street rods, or motorcycles.

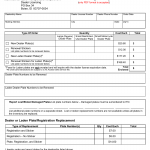

Form ITD 3682. Military Plates

Form ITD 3682 is used in Idaho by individuals who are current or former members of the military and wish to apply for military license plates that honor their military service. The main purpose of this form is to facilitate the application process for obtaining military license plates.

Form ITD 3702. Title Stop Request

Form ITD 3702 is used in Idaho by individuals who need to request a stop on the issuance of a vehicle title. The main purpose of this form is to prevent the Department of Motor Vehicles (DMV) from issuing a title for a specific vehicle.