New York State DMV Forms 2

The New York State Department of Motor Vehicles (DMV) provides a comprehensive list of forms that are crucial for various motor vehicle-related processes and programs.

Form AA-53.2. Statement In Place of Personal Appearance

The AA-53.2 Form, also known as the Statement In Place of Personal Appearance, is a crucial document used by the New York State Department of Motor Vehicles (DMV). This form serves the purpose of providing a detailed statement in lieu of appearing in person for certain DMV transactions.

Form VA-004. Report of Motor Vehicle Crash

The VA-004 Form, also known as the Report of Motor Vehicle Crash, is a crucial document administered by the Department of Motor Vehicles (DMV). This form serves the purpose of reporting and documenting detailed information about motor vehicle accidents.

Texas Business Appliction Permit Forms

If you're doing business in Texas, it's essential to be aware of the various forms required by the state government. From tax permits to exemption applications, there are plenty of documents that you need to file to operate legally.

SCDMV Form 447-CM. Consent for Minor

Form 447-CM, also known as Consent for Minor, is a vital document used by the South Carolina Department of Motor Vehicles (DMV). This form serves the purpose of obtaining consent from a parent or legal guardian for a minor to engage in certain activities or transactions related to the DMV.

PS Form 3907. Mail Pickup Notice

PS Form 3907, also known as the Mail Pickup Notice, is a crucial document used by individuals or businesses to request mail collection from their designated postal service provider.

PS Form 3883-A. Firm Delivery Receipt

The PS Form 3883-A, also known as the "Firm Delivery Receipt," is a vital document used by the United States Postal Service (USPS). This form serves the purpose of confirming the receipt of a package or mail item by the recipient or an authorized representative.

Form MV11-1. Wisconsin Title & License Plate Application

The Wisconsin Title & License Plate Application, also known as Form MV11-1, is an essential document used for the purpose of applying for a title and license plate in the state of Wisconsin.

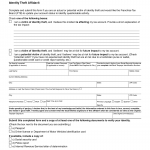

Form FTB-3552. Identity Theft Affidavit

Form FTB-3552, the Identity Theft Affidavit, is a crucial document used by individuals who have been victims of identity theft in the state of California.

Form HSMV 82152. Application for Surviving Spouse Transfer of Title

The HSMV 82152 form, issued by the Florida Department of Highway Safety and Motor Vehicles, serves as an application for surviving spouses in Florida to transfer the title of a vehicle after their spouse's death.