IRS Form 8863. Education Credits

IRS Form 8863, also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is a tax form used by taxpayers who qualify for educational tax credits.

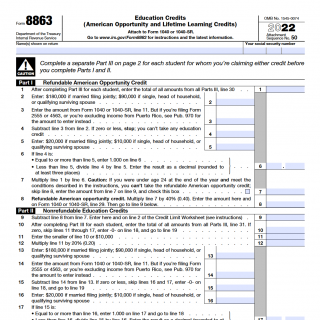

The form consists of four parts: Part I, which is for the taxpayer's identification information; Part II, which is for the American Opportunity Credit; Part III, which is for the Lifetime Learning Credit; and Part IV, which is for the refundable American Opportunity Credit.

The form is drawn up in cases where the taxpayer or their dependent has incurred qualified education expenses, such as tuition and fees, at an eligible educational institution. The parties involved are the taxpayer and the educational institution.

When compiling the form, it is important to consider the eligibility requirements for each credit, as well as the amount of qualified education expenses and the taxpayer's income. For example, the American Opportunity Credit is only available for the first four years of post-secondary education, and the Lifetime Learning Credit has income limitations.

Real cases of using Form 8863 include a student who has paid tuition and fees out of pocket, as well as a parent who has paid for their child's education expenses. The advantages of this form include the potential for substantial tax savings, as the credits can be worth up to $2,500 and $2,000 respectively. However, if the form is filled out incorrectly, the taxpayer may be subject to penalties and interest charges. It is important to carefully review the instructions and seek professional assistance if needed to ensure accurate completion of the form.

To fill out Form 8863 accurately, taxpayers should ensure that they have all necessary documentation, such as tuition statements or receipts for education expenses. They should also carefully review the eligibility requirements for each credit and double-check all calculations. Taxpayers who are unsure about how to fill out the form should consider seeking assistance from a tax professional or using tax preparation software.

Form 8863 should be attached to Form 1040 or Form 1040-SR when filing taxes. Taxpayers should ensure that all forms and attachments are included when filing their tax return to avoid processing delays or penalties.

Related forms to Form 8863 include Form 1098-T, which reports qualified education expenses, Form 1098-E, which reports student loan interest paid, and Form 8332, which releases the claim to child tax credit or other dependent-related tax benefits. Taxpayers should carefully review the instructions for these forms and ensure they are completed accurately and attached to the tax return as necessary.

Mailing Addresses for Form 8863

When filing Form 8863, taxpayers must ensure that it is mailed to the correct address to avoid processing delays or other issues. The mailing address for Form 8863 depends on the state of residence and whether or not a payment is included. Here are the possible mailing addresses based on your situation:

- If you live in Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, or West Virginia, AND you are NOT including a payment, mail your Form 8863 to the Department of the Treasury, Internal Revenue Service in Kansas City, MO 64999-0002.

- If you live in the same states as above AND you ARE including a payment, mail your Form 8863 to the Internal Revenue Service, P.O. Box 806532, Cincinnati, OH 45280-6532.

- If you live in Alaska, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, or Wyoming, AND you are NOT including a payment, mail your Form 8863 to the Department of the Treasury, Internal Revenue Service in Fresno, CA 93888-0002.

- If you live in the same states as above AND you ARE including a payment, mail your Form 8863 to the Internal Revenue Service, P.O. Box 932100, Louisville, KY 40293-2100.

It is essential to ensure that the correct mailing address is used to avoid any delays or issues in processing the form.