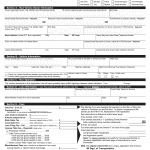

Form ITD 3763. Idaho Order 30-Day Temporary Registration Permit Form

Form ITD 3763, also known as the "Order 30-Day Temporary Registration Permit Forms," is a document provided by the Idaho Department of Motor Vehicles (DMV). This form serves as a request for obtaining temporary registration permits for vehicles in the state of Idaho.

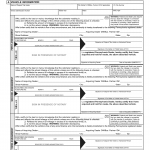

Form MV1. Application for Title

The MV1 - Application for Title is a crucial document used in the state of Wisconsin for individuals seeking to obtain a title for a vehicle. This form serves as an official application and must be completed accurately and comprehensively.

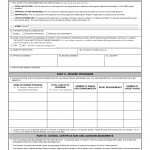

Form MV-27. Dealer Assignment Covering a Vehicle Acquired and Held for Resale

Form MV-27, also known as the "Dealer Assignment Covering a Vehicle Acquired and Held for Resale," is an essential document used by authorized vehicle dealers in Pennsylvania.

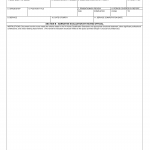

Form DMV 65 MCP. Certificate of Insurance

DMV 65 MCP, also known as Certificate of Insurance Motor Carriers of Property, is an important document issued by the California Department of Motor Vehicles (DMV) for motor carriers engaged in the transportation of property within the state of California.

VA Form 22-1990. Application for VA Education Benefits

The VA Form 22-1990, also known as the "Application for VA Education Benefits," is an essential document for veterans or eligible dependents seeking educational assistance from the Department of Veterans Affairs (VA).

VA Form 22-0976. Application for Approval of a Program in a Foreign Country

VA Form 22-0976, the Application for Approval of a Program in a Foreign Country, is a document used by the Department of Veterans Affairs (VA) to evaluate and approve educational programs offered in foreign countries for veterans and eligible dependents.

VA Form 10-2623. Proficiency Report - Electronic Signatures

VA Form 10-2623, also known as the Proficiency Report - Electronic Signatures, is a document used by the Department of Veterans Affairs (VA) to assess the proficiency and competency of healthcare providers within the VA system.

Form LIC 508. Criminal Record Statement & Out-Of-State Disclosure

Form LIC 508 is a crucial document that serves as a criminal record statement and out-of-state disclosure for individuals applying for a license or permit.

Form LIC 281. Application Instructions for A Facility License

Form LIC 281 serves as a comprehensive guide and set of instructions for individuals or entities seeking to apply for a facility license.

VA Form 0239. Leave Transfer Authorization

The VA Form 0239 Leave Transfer Authorization is a document used by employees of the Department of Veterans Affairs (VA) in the United States to request and authorize the transfer of unused annual leave to another employee who is experiencing a medical emergency or severe personal hardship.