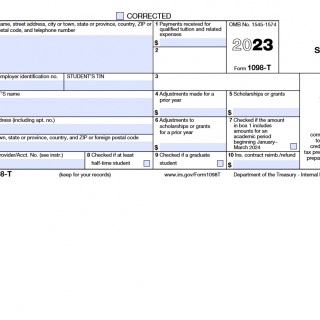

IRS Form 1098-T. Tuition Statement

IRS Form 1098-T is used to report tuition payments made by a student or their parents during the tax year. The form is typically provided by eligible educational institutions to students who are enrolled in courses that lead to a degree, certificate, or other recognized educational credential.

The form consists of two parts. Part I includes information about the student, including their name, address, and taxpayer identification number. Part II includes information about the educational institution, including their name, address, and taxpayer identification number. This section also includes information about the tuition payments made by the student or their parents during the tax year, as well as any scholarships or grants that were received.

This form is drawn up by eligible educational institutions that have received payments for qualified tuition and related expenses, such as fees and books, during the tax year. The parties involved are the educational institution that is reporting the tuition payments, and the student or their parents who made the payments.

When compiling this form, it's important to take into account that the tuition payments must be for qualified expenses, and that any scholarships or grants received must be subtracted from the total amount of tuition paid. It's also important to ensure that the information provided on the form is accurate and up-to-date.

The advantages of this form include the ability to reduce taxable income by claiming education-related tax credits, such as the American Opportunity Credit or the Lifetime Learning Credit. However, if the form is filled out incorrectly, there can be potential problems, such as underreporting or overreporting the amount of tuition paid, which can result in penalties or audits by the IRS. Therefore, it's important for students and educational institutions to ensure that they are accurately reporting their tuition payments on this form.