SCDMV Form 447-CM. Consent for Minor

Form 447-CM, also known as Consent for Minor, is a vital document used by the South Carolina Department of Motor Vehicles (DMV). This form serves the purpose of obtaining consent from a parent or legal guardian for a minor to engage in certain activities or transactions related to the DMV.

PS Form 3907. Mail Pickup Notice

PS Form 3907, also known as the Mail Pickup Notice, is a crucial document used by individuals or businesses to request mail collection from their designated postal service provider.

PS Form 3883-A. Firm Delivery Receipt

The PS Form 3883-A, also known as the "Firm Delivery Receipt," is a vital document used by the United States Postal Service (USPS). This form serves the purpose of confirming the receipt of a package or mail item by the recipient or an authorized representative.

Form MV-753 - Authorization for Release of Motor Vehicle / Driver Record Information

The MV-753 form, officially titled "Authorization for Release of Motor Vehicle/Driver Record Information," is a Pennsylvania Department of Transportation (PennDOT) document designed to grant authorized agents or messengers permission to access an individual’s driver and vehicle records.

Form MV11-1. Wisconsin Title & License Plate Application

The Wisconsin Title & License Plate Application, also known as Form MV11-1, is an essential document used for the purpose of applying for a title and license plate in the state of Wisconsin.

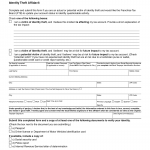

Form FTB-3552. Identity Theft Affidavit

Form FTB-3552, the Identity Theft Affidavit, is a crucial document used by individuals who have been victims of identity theft in the state of California.

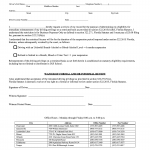

Form HSMV 82152. Application for Surviving Spouse Transfer of Title

The HSMV 82152 form, issued by the Florida Department of Highway Safety and Motor Vehicles, serves as an application for surviving spouses in Florida to transfer the title of a vehicle after their spouse's death.

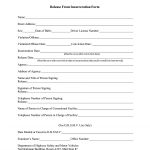

Form HSMV 72077. Release From Incarceration Form

The HSMV 72077 Release From Incarceration Form, issued by the Florida Department of Highway Safety and Motor Vehicles, serves a vital purpose in facilitating the legal release of individuals who have been incarcerated.

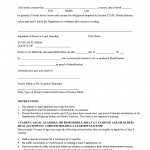

Form HSMV 72034. Request for Eligibility Review

Form HSMV 72034, known as the Request for Eligibility Review, is a vital document used by the Florida Department of Highway Safety and Motor Vehicles. This form serves the purpose of initiating a review of eligibility for specific driver-related matters.

Form HSMV 71142 - Parent Consent Form (Under 18 – Learner’s License)

The HSMV 71142 form, commonly known as the Parent Consent Form (Under 18 – Learner’s License), is an essential document issued by the Florida Department of Highway Safety and Motor Vehicles.