DD Form 2131. Passenger Manifest

The DD Form 2131, also known as Passenger Manifest, is a document used by the Department of Defense to record the transportation of military personnel and their dependents.

Trampoline Waiver Form

A trampoline waiver form is a legal document that participants must fill out and sign before engaging in activities on a trampoline.

Complaint Letter Against Employee Misbehavior

When an employee misbehaves, it is important to take action and lodge a complaint. The main purpose of this letter is to report the unacceptable behavior of an employee to their employer or HR department.

NCDMV Form MVR-4. Application for Duplicate Title

The MVR-4 form is an Application for Duplicate Title issued by the North Carolina Department of Motor Vehicles (NCDMV). The purpose of this form is to apply for a duplicate title in case the original one has been lost or misplaced.

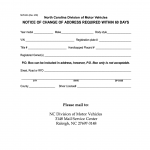

NCDMV Form MVR-24A. Notice of Change of Address

The MVR-24A is a form used by the North Carolina Department of Motor Vehicles (NCDMV) for the purpose of notifying the department of a change in address. This form is important for individuals who have recently moved and need to update their address information with the NCDMV.

SCDMV Form 452-A. Lost/Stolen or Destroyed License Plate Report Replacement Application (IRP Only)

The SCDMV Form 452-A is a Lost/Stolen or Destroyed License Plate Report Replacement Application specifically designed for the International Registration Plan (IRP) in South Carolina. The form serves the purpose of reporting lost, stolen, or damaged license plates, and requesting replacements.

SCDMV Form 4057. Change of Address, Name, Date of Birth, and/or Social Security Number

The SCDMV Form 4057 is a document used to request changes to personal information with the South Carolina Department of Motor Vehicles. This form can be used to update a person's name, address, date of birth, and/or social security number.

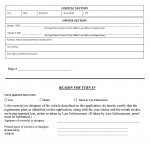

Form MVR-18A. Application for Plate Turn in Verification

MVR-18A is an application form used by the North Carolina Department of Motor Vehicles to facilitate the Plate Turn in Verification process. This form is used by individuals who wish to surrender their license plate(s) and receive a receipt of confirmation from the DMV.

Form LIC 610D. Emergency Disaster Plan For Adult Day Programs, Adult Residential Facilities, Residential Care Facilities For The Chronically Ill And Social Rehabilitation Facilities

The Emergency Disaster Plan for Adult Day Programs, Adult Residential Facilities, Residential Care Facilities for the Chronically Ill and Social Rehabilitation Facilities is a form provided by the California Department of Social Services.

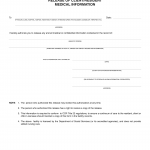

Form LIC 605A. Release Of Client/Resident Medical Information

LIC 605A is a form used to release client/resident medical information by the California Department of Social Services, Community Care Licensing.