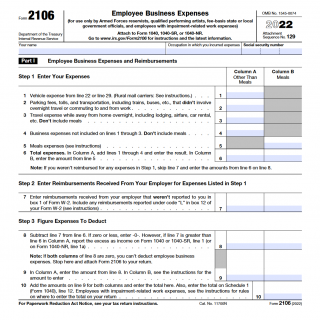

IRS Form 2106. Employee Business Expenses

Form 2106, Employee Business Expenses, is used to claim deductions for expenses related to a job or business, such as mileage, travel, and supplies. The form is divided into two parts, Part I and Part II.

Part I is used to calculate employee business expenses that are not reimbursed by an employer. This includes expenses such as travel, meals, and entertainment, as well as home office expenses and job search expenses. The total amount of expenses is then transferred to Schedule A (Form 1040) as a miscellaneous itemized deduction.

Part II is used to calculate expenses that are reimbursed by an employer but are not included in the employee's income. This includes expenses such as business use of a personal vehicle and travel expenses. The total amount of expenses is then deducted from the employee's income on Form 1040.

The form is typically drawn up by employees who have incurred business expenses that were not reimbursed by their employer, and who wish to claim these expenses as a deduction on their tax return. The parties involved are the employee and the Internal Revenue Service (IRS).

When compiling Form 2106, it is important to ensure that all expenses are properly documented and that the form is completed accurately. This includes keeping receipts and records of all business expenses, and ensuring that all calculations are correct and in compliance with IRS regulations.

The advantages of Form 2106 include the ability to claim deductions for business expenses that were not reimbursed by an employer, which can help to lower taxable income and potentially lower tax bills. However, if the form is filled out incorrectly or if expenses are not properly documented, there is a risk of the IRS disallowing the deductions and potentially imposing penalties and interest.

It is important to note that as of tax year 2018, employee business expenses are no longer deductible as miscellaneous itemized deductions on Schedule A. However, certain employees who are considered "qualified employees" may still be able to deduct unreimbursed employee expenses on Form 2106, as part of their above-the-line deductions.

Tips for reducing taxes using Form 2106

- Keep accurate records of all business-related expenses, including receipts, invoices, and mileage logs.

- Be sure to claim all eligible expenses, including travel, meals, and entertainment, as well as home office expenses and job search expenses.

- If possible, try to time your expenses so that you can claim them in a year when your income is higher, as this will help to maximize your tax savings.

- Consider using a tax professional to help you navigate the complex rules and regulations surrounding employee business expenses.

- Be sure to check the latest IRS guidelines and regulations to ensure that you are in compliance and taking advantage of all available deductions.