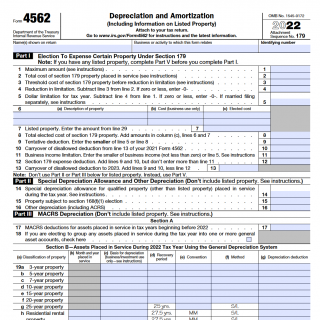

IRS Form 4562. Depreciation and Amortization

IRS Form 4562, also known as the Depreciation and Amortization form, is used by businesses to report the depreciation and amortization of their assets.

The form consists of five parts, including Part I, which is used to report the assets that are being depreciated or amortized, Part II, which is used to report the information about the business that is claiming the depreciation or amortization, Part III, which is used to report the depreciation and amortization deductions for the current year, Part IV, which is used to report any special depreciation allowances, and Part V, which is used to report the depreciation and amortization deductions for the Alternative Minimum Tax (AMT) purposes.

This form is typically drawn up by businesses that have purchased assets that will be used over a period of time, such as buildings, equipment, and vehicles. The parties involved are the business claiming the depreciation or amortization deductions and the IRS.

It's important to note that there are certain features that should be taken into account when compiling this form. For example, businesses must use the correct depreciation method for each asset, and must also take into account any special depreciation allowances that may apply. Additionally, businesses must ensure that they are following all applicable tax laws and regulations when claiming these deductions.

The advantages of this form include the ability to reduce taxable income by taking deductions for the wear and tear of assets over time. However, if the form is filled out incorrectly, there can be potential problems, such as underestimating or overestimating the deductions, which can result in penalties or audits by the IRS. Therefore, it's important for businesses to ensure that they are accurately reporting their depreciation and amortization deductions on this form.