Form REG 172. Vehicle Moving Permit

The REG 172 Vehicle Moving Permit, issued by the California Department of Motor Vehicles (DMV), is a crucial form used for obtaining permission to move an unregistered vehicle within the state.

Form HSMV 74038. Satisfaction of Judgment

Form HSMV 74038, Satisfaction of Judgment, is a vital document provided by the Florida Department of Highway Safety and Motor Vehicles.

Form VTR-340. Surrendered Ownership Evidence for Vehicles to be Dismantled, Scrapped, or Destroyed

The Form VTR-340, also known as the Surrendered Ownership Evidence for Vehicles to be Dismantled, Scrapped, or Destroyed form, is a document provided by the Texas Department of Motor Vehicles (TxDMV).

Form NC-4. Employee's Withholding Allowance Certificate

The Employee's Withholding Allowance Certificate NC-4 is a form issued by the North Carolina Department of Revenue. It serves as a means for employees to designate their tax withholding preferences for state income taxes in North Carolina.

Affidavit of Affixation

An affidavit of affixation is a legal document used to establish and declare that a manufactured home or mobile home has been permanently affixed to real property. It serves as proof that the home is no longer considered personal property, but rather a part of the real estate.

Form LIC 701. Physician's Report - Child Care Centers

The LIC 701 form, also known as the Physician's Report - Child Care Centers, is a crucial document that serves an important role in California's Department of Social Services' Community Care Licensing program.

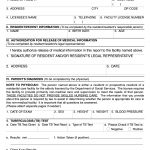

Form LIC 627A. Consent To A Medical Examination

The LIC 627A form, titled "Consent to a Medical Examination," is an essential document governed by the California Department of Social Services, Community Care Licensing.

Form LIC 627. Consent For Emergency Medical Treatment - Child Care Centers Or Family Child Care Homes

The LIC 627 form, also known as the "Consent for Emergency Medical Treatment - Child Care Centers or Family Child Care Homes," is a crucial document regulated by the California Department of Social Services, Community Care Licensing.

Form LIC 603. Preplacement Appraisal Information

The LIC 603 form, also known as Preplacement Appraisal Information, is a significant document regulated by the California Department of Social Services' Community Care Licensing.

Form LIC 602A. Physician's Report For Residential Care Facilities For The Elderly (RCFE)

The LIC 602A form, also known as the Physician's Report for Residential Care Facilities for the Elderly (RCFE), is a vital document required by the California Department of Social Services' Community Care Licensing.