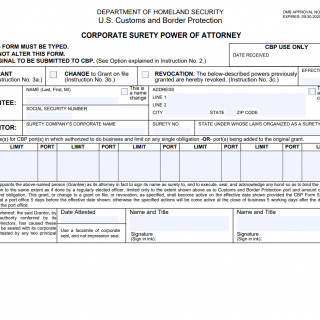

CBP Form 5297. Corporate Surety Power of Attorney

If you are involved in international trade, you may be familiar with CBP Form 5297 - Corporate Surety Power of Attorney. This form is used by importers and exporters to authorize a customs broker to act on their behalf in matters related to importing and exporting goods. In this article, we will provide a detailed description of CBP Form 5297, including its purpose, parts, and advantages.

The purpose of CBP Form 5297 is to grant a customs broker the authority to act on behalf of an importer or exporter in matters related to importing and exporting goods. This includes the power to sign documents, pay duties and taxes, and make other decisions related to the shipment of goods.

CBP Form 5297 consists of several parts, including the name and address of the importer or exporter, the name and address of the customs broker, and a list of the powers granted to the customs broker. The most important fields on the form include the name and address of the importer or exporter, as well as the powers granted to the customs broker.

CBP Form 5297 is typically compiled when an importer or exporter wishes to authorize a customs broker to act on their behalf. The parties to the document are the importer or exporter and the customs broker.

When compiling CBP Form 5297, it is important to ensure that all fields are completed accurately and that the powers granted to the customs broker are clearly stated. It is also important to ensure that the form is signed by a person authorized to act on behalf of the importer or exporter.

The advantages of CBP Form 5297 include the ability to authorize a customs broker to act on behalf of an importer or exporter, which can save time and simplify the process of importing and exporting goods. It also provides a clear record of the powers granted to the customs broker, which can be useful in the event of a dispute.

One potential problem that can arise when filling out CBP Form 5297 is errors or omissions in the information provided. This can result in delays or other issues with the shipment of goods. It is important to ensure that all fields are completed accurately and that the form is signed by a person authorized to act on behalf of the importer or exporter.

Related forms to CBP Form 5297 may include CBP Form 5106 - Importer ID Input Record, which is used to provide information about the importer or exporter, and CBP Form 7501 - Entry Summary, which is used to declare the value and classification of imported goods. An alternative form could be a general power of attorney, which grants a person or entity the authority to act on behalf of the importer or exporter in a variety of matters.

CBP Form 5297 should be submitted to the customs broker who will be acting on behalf of the importer or exporter. Once completed, the form should be stored in a secure location for future reference.