SCDMV Form IFTA-13. New IFTA Account Checklist

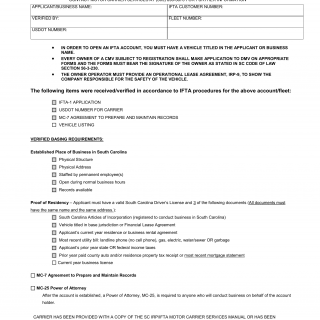

This form is used by individuals or businesses who wish to apply for a new International Fuel Tax Agreement (IFTA) account in the state of South Carolina. The purpose of this form is to provide a checklist of all the required documents and information that must be submitted with the application.

The form consists of a list of items that need to be completed or submitted, such as proof of liability insurance, copies of fuel receipts, proof of vehicle ownership, and payment for the required fees. Each item is accompanied by a checkbox to indicate whether it has been completed or submitted.

Important fields on this form include the applicant's personal or business information, including name, address, and contact details. Additionally, the form requires detailed information about the vehicles that will be covered under the IFTA account, such as the vehicle identification number (VIN), license plate number, and the percentage of distance traveled in each jurisdiction.

When filling out this form, it is important to carefully review the checklist and ensure that all required documents and information are included. Failure to provide the necessary documentation or complete the required fields may result in delays or rejection of the application.

An example of an application scenario for this form would be a trucking company that operates across multiple jurisdictions and needs to establish an IFTA account to simplify the reporting and payment of fuel taxes. By using this form, the company can ensure that they have gathered all the necessary documentation and information to complete the application process.

An alternative form that may be related to this one is SCDMV Form IFTA-12. This form is used for IFTA Renewals and Account Updates. While both forms serve the purpose of establishing or updating an IFTA account, SCDMV Form IFTA-13 specifically focuses on new account applications, whereas SCDMV Form IFTA-12 is used for renewals and updates of existing accounts.