Who must file Form 709

Form 709 must be filed by an individual who made certain gifts during a calendar year that are subject to federal gift tax reporting rules. Filing is required based on the type of gift, its value, and how the gift is structured, even if no gift tax is ultimately owed.

Form 709 instructions and practical guide

Form 709 is the federal tax return used to report taxable gifts and certain generation-skipping transfers made by an individual during a calendar year.

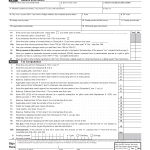

IRS Form 709. United States Gift (and Generation-Skipping Transfer) Tax Return

IRS Form 709 is the official federal tax return used to report taxable gifts and certain generation-skipping transfers made by an individual during a calendar year.

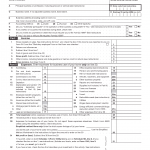

IRS Form 1040 Schedule C

IRS Form 1040 Schedule C is an official schedule used to report income and expenses from a trade or business operated by an individual. It is filed as part of Form 1040 and serves to calculate the net profit or net loss from business activity for inclusion in the individual income tax return.

How Schedule C Relates to Form 1040

IRS Schedule C is not filed on its own. It is completed as a supporting schedule and included with Form 1040 as part of an individual income tax return. The purpose of this relationship is to integrate business activity into the overall tax reporting framework for individuals.

Schedule C vs Schedule F

IRS Schedule C and Schedule F are used to report different types of income from business activities on an individual income tax return.

Schedule C vs Schedule E

IRS Schedule C and Schedule E are used to report different types of income on an individual income tax return. The distinction between these schedules depends on how the activity is classified under federal tax rules, not simply on the source of the income.

Excess Business Loss Rules and IRS Schedule C

The excess business loss rules may limit how much of a business loss reported on IRS Schedule C can be applied against other income in a given tax year. These rules affect how Schedule C losses are treated within the individual income tax return after the form is completed.

At-Risk Rules and IRS Schedule C

The at-risk rules may affect how losses reported on IRS Schedule C are treated for tax purposes. These rules limit the amount of loss an individual can claim to the amount that is considered economically at risk in the business activity.

Passive Activity Limits and IRS Schedule C

Passive activity limits may affect how losses reported on IRS Schedule C are treated within the individual income tax return. These rules are designed to restrict the use of losses from certain business activities against other types of income.