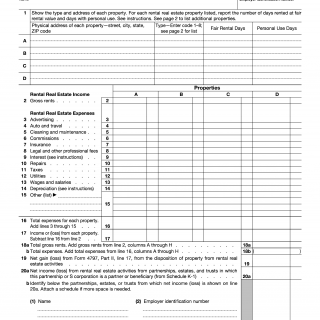

IRS Form 8825. Rental Real Estate Income and Expenses of a Partnership or an S Corporation

Form 8825 is an official IRS document used by partnerships and S corporations to report income and expenses from rental real estate activities. This form is filed together with Form 1065 (U.S. Return of Partnership Income) or Form 1120-S (U.S. Income Tax Return for an S Corporation).

The purpose of IRS Form 8825 is to calculate and report the net rental income or loss from properties owned by the business entity. It helps determine the taxable portion of rental operations, including apartments, office buildings, commercial spaces, and other investment properties.

The form requires details such as:

-

Physical address and type of each property (single-family, multi-family, commercial, etc.)

-

Number of rental and personal-use days

-

Income categories like gross rents

-

Expense categories including advertising, maintenance, insurance, repairs, taxes, interest, depreciation, and wages

Form 8825 consists of multiple sections for reporting each property individually. Lines 18–21 summarize total rental income, expenses, and net gains or losses for all listed properties. Supporting schedules like Form 4562 (Depreciation and Amortization) may also be required.

Partnerships and S corporations must ensure accuracy, as errors can lead to IRS penalties or misreported taxable income. The information from this form directly affects the business’s Schedule K and Schedule K-1, influencing how income and losses flow to partners or shareholders.

Who uses Form 8825:

-

Real estate partnerships and S corporations

-

Businesses owning multiple rental properties

-

Companies reporting income from vacation rentals, commercial leases, or land

Alternative forms:

-

Schedule E (Form 1040) – for individual rental property owners

-

Form 1065 – for partnerships reporting overall income and deductions

Accurate completion of Form 8825 ensures compliance with U.S. tax law and provides a transparent record of rental real estate performance. You can download a fillable PDF Form 8825, print it, or fill it out online directly from our site.