Form 540. California Resident Income Tax Return

The California Resident Income Tax Return, also known as Form 540, is a tax form used by California residents to file their state income tax returns. The main purpose of this form is to report the amount of income earned in California and calculate the appropriate amount of state income tax owed or refund due.

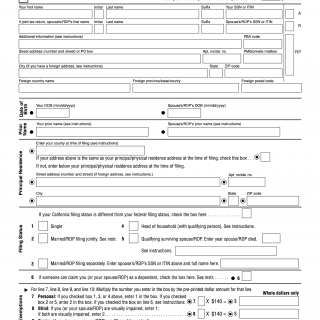

Form 540 consists of several parts, including personal information, income and adjustments, tax liability, payments and credits, and other taxes. Some important fields to consider when filling out the form include your name, social security number, filing status, income sources, deductions, and exemptions.

When filling out Form 540, you will need to provide various data, including your income and deductions, which can be found on your W-2s, 1099s, and other tax documents. You may also need to attach additional forms and schedules, such as Schedule CA (California Adjustments), to support your claims.

Examples of practice and use cases for Form 540 include individuals who are California residents and have earned income from wages, self-employment, interest, dividends, or rental properties. It is important to note that failure to file and pay taxes owed can result in penalties and interest charges.

Strengths of Form 540 include its ease of use and availability online, while weaknesses may include complex tax laws and regulations that can make it difficult to fill out correctly. Opportunities for improvement could include simplifying the form and providing more guidance for taxpayers. Threats may include fraud and identity theft related to sensitive personal information on the form.

Related forms include the federal tax return form 1040, as well as alternative forms for California residents such as Form 540NR (Nonresident or Part-Year Resident Income Tax Return) and Form 540 2EZ (California Resident Income Tax Return).

Filing Form 540 affects the future of participants by fulfilling their tax obligations and ensuring compliance with state tax laws. The form can be submitted electronically or by mail and is stored by the California Franchise Tax Board.