Loan Appeal Letter

Challenge Decision for Loan Application

A loan appeal letter serves as a formal written communication submitted by a borrower to challenge a decision made by a lending institution regarding a loan application, loan modification, or loan denial. The letter aims to request a review of the loan decision, presenting a persuasive argument with supporting documentation for reconsideration. By submitting this letter, borrowers seek to potentially secure the desired loan outcome or revised terms.

Important Considerations:

- Main Purpose: The main purpose of the loan appeal letter is to challenge and contest a lending institution's decision regarding a loan application or modification, with the goal of securing a favorable outcome.

- Parties Involved: The borrower (applicant) submits the letter to the lending institution responsible for making the loan decision.

- Key Parts: The loan appeal letter consists of an opening, introduction, reasons for appeal, supporting documentation, persuasive argument, request for review, and closing.

- Required Data: The borrower must provide their personal information, loan details, and factual information relevant to the appeal.

- Additional Documents: Supporting documents such as financial statements, proof of income, tax returns, credit reports, or any other relevant documentation must be attached to strengthen the appeal.

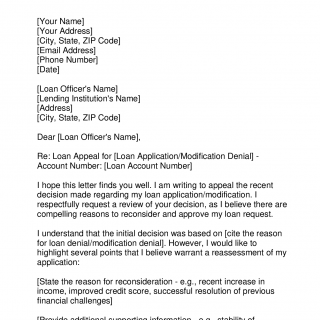

Sample of Loan Appeal Letter

[Your Name][Your Address][City, State, ZIP Code][Email Address][Phone Number][Date][Loan Officer's Name][Lending Institution's Name][Address][City, State, ZIP Code]Dear [Loan Officer's Name],Re: Loan Appeal for [Loan Application/Modification Denial] - Account Number: [Loan Account Number]I hope this letter finds you well. I am writing to appeal the recent decision made regarding my loan application/modification. I respectfully request a review of your decision, as I believe there are compelling reasons to reconsider and approve my loan request.I understand that the initial decision was based on [cite the reason for loan denial/modification denial]. However, I would like to highlight several points that I believe warrant a reassessment of my application:[State the reason for reconsideration - e.g., recent increase in income, improved credit score, successful resolution of previous financial challenges][Provide additional supporting information - e.g., stability of employment, positive cash flow, commendable repayment history]In support of my appeal, I have attached the following relevant documents for your reference and evaluation:[List the attached supporting documents, such as recent bank statements, pay stubs, tax returns, credit report, or any other documents that strengthen your case]Furthermore, I would like to emphasize my strong commitment to fulfilling my financial obligations. I understand the responsibilities that come with acquiring a loan, and I assure you that I will diligently adhere to the agreed-upon terms and make timely repayments.Considering the outlined circumstances and supporting documentation, I kindly request that you review my situation thoroughly and grant the loan approval/modification that I am seeking. This would not only assist me in meeting my financial needs but also enable me to contribute to the growth of my business/homeownership.I would greatly appreciate the opportunity to discuss my situation further or provide any additional information that may be required. Please feel free to contact me at your earliest convenience via phone or email provided above.Thank you for your prompt attention to this matter. I am confident that, upon review, you will recognize the validity of my appeal and reconsider your decision favorably. I look forward to a positive response and appreciate your time and consideration.Yours sincerely,[Your Name]

Strengths:

- Provides a formal and documented channel for appealing a loan decision.

- Allows the borrower to present a comprehensive argument with supporting evidence, enhancing the chances of a successful appeal.

Weaknesses:

- Success is not guaranteed, as the lending institution has the final decision-making authority.

- Potential delays in the loan process due to the appeal and review period.

Opportunities:

- Offers a chance for borrowers to rectify any misunderstandings or provide additional information that may positively impact the loan decision.

- Enables the borrower to demonstrate their commitment, responsibility, and ability to repay the loan.

Threats:

- Existing financial weaknesses, such as high debt levels or poor credit history, may negatively influence the appeal outcome.

- Failure to present a well-constructed argument or provide sufficient supporting documentation can weaken the appeal.

Alternative Forms:

- Personal Interview: Requesting an in-person meeting or phone call with the lending institution to discuss the loan decision.

- Additional Financial Documentation: Submitting more detailed financial records or supplementary evidence to support the loan appeal.

- Reapplication: Instead of appealing, borrowers may choose to reapply for the loan with improved information or circumstances.

Differences:

- The loan appeal letter provides a formal written record of the appeal, ensuring that all relevant information is submitted for review.

- Personal interviews or additional financial documentation may offer an opportunity for real-time communication or further explanation.

For borrowers, a successful loan appeal can lead to securing the desired loan outcome or revised terms, providing financial opportunities and meeting their goals. Lending institutions have the opportunity to review and reconsider their decisions in light of valid appeals, potentially strengthening trust and customer relationships.

The loan appeal letter should be submitted through a secure method specified by the lending institution, such as certified mail or designated online portals. It is advisable for both the borrower and the lending institution to retain copies of the letter and related documents for future reference and record-keeping purposes.

Example use cases and practice:

- John, a small business owner, submits a loan appeal letter to challenge the denial of his loan application due to a recent temporary drop in revenue. He attaches detailed financial statements, tax returns, and a persuasive argument highlighting improvements in his business operations and future projections. John aims to secure the loan to invest in new equipment and expand his business.

- Emily, a homeowner, writes a loan appeal letter to request reconsideration of a loan modification that was denied due to a misunderstanding of her financial situation. She attaches supporting documentation, including proof of increased income and repayment capabilities. Emily hopes to revise the terms of her loan to prevent foreclosure and maintain homeownership.