Credit Report Form

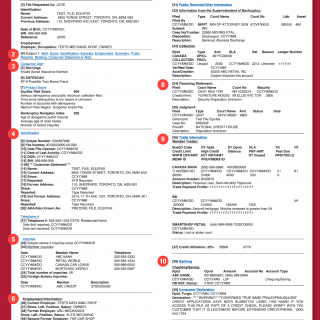

A credit report is a document that contains information about an individual's credit history, including their credit accounts, payment history, and outstanding debts. The main purpose of obtaining a credit report is to review and verify the accuracy of the information it contains.

To obtain a copy of your credit report, you will need to fill out a credit report request form. This form typically consists of personal information fields, such as name, address, social security number, and date of birth. It is important to provide accurate and complete information to ensure that the credit report received is for the correct individual.

The parties involved in this process are the individual requesting the credit report and the credit bureau that provides the report. There are three major credit bureaus in the United States: Equifax, Experian, and TransUnion. It is important to note that each credit bureau may have different information on file, so it is recommended to obtain a report from each bureau.

When filling out the credit report request form, you will need to provide some additional information to verify your identity, such as a copy of your driver's license or passport. It is important to attach these documents to the form to ensure that the credit bureau can confirm your identity.

Application examples of this form include when an individual is applying for a loan or credit card and wants to review their credit history beforehand, or when an individual suspects that there may be inaccuracies on their credit report and wants to verify the information.

Strengths of this form include the ability to obtain a comprehensive view of an individual's credit history and identify any errors or inaccuracies. Weaknesses may include the potential for identity theft if the documents attached to the form are not stored securely.

Alternative forms may include online credit report requests or requests made over the phone. However, it is still important to provide accurate and complete information and attach any necessary documentation.

Once the credit report request form is filled out and submitted, it is recommended to store a copy of the form and any attached documentation in a secure location. The credit report itself should also be stored securely, as it contains sensitive personal information.

To obtain a copy of your credit report from a credit bureau, you can follow these steps:

- Identify the credit bureau you want to obtain the report from. There are three major credit bureaus in the United States: Equifax, Experian, and TransUnion.

- Visit the website of the credit bureau you want to obtain the report from. You can find the website by searching for the credit bureau's name on a search engine.

- Look for the section on the website that allows you to request a copy of your credit report. This section may be labeled "Get my free credit report" or "Request my credit report".

- Fill out the online form with your personal information, such as your name, address, and Social Security number.

- Choose the type of credit report you want to obtain. You may be able to choose between a free credit report or a paid credit report that includes additional information.

- Submit your request and wait for your credit report to be generated. This may take a few minutes or a few days, depending on the credit bureau's processing time.

- Review your credit report carefully for accuracy and report any errors or discrepancies to the credit bureau. This will help ensure that your credit report is up-to-date and accurate.