Letter of Credit

A Letter of Credit (LC) is a document issued mostly by a banks, used primarily in trade finance, which usually provides an irrevocable payment undertaking. This means that if buyer do not perform his obligations, his bank pays. The letter of credit can also be the source of repayment of the transaction meaning that the exporter will get paid with the redemption of the letter of credit.

Letters of credit are used primarily in international trade transactions of significant value, for deals between a supplier in one country and a customer in another. They are also used in the land development process to ensure that approved public facilities will be built. The parties to a letter of credit are usually a beneficiary who is to receive the money, the issuing bank of whom the applicant is a client, and the advising bank of whom the beneficiary is a client.

Letters of credit are often used in international transactions to ensure that payment will be received. Due to the nature of international dealings including factors such as distance, differing laws in each country and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect of international trade. The bank also acts on behalf of the buyer - holder of letter of credit - by ensuring that the supplier will not be paid until the bank receives a confirmation that the goods have been shipped.

Almost all letters of credit are irrevocable, i.e., cannot be amended or cancelled without prior agreement of the beneficiary, the issuing bank and the confirming bank, if any. In executing a transaction, letters of credit incorporate functions common to giro's and Traveller's cheques. Typically, the documents a beneficiary has to present in order to receive payment include a commercial invoice, bill of lading, and documents proving the shipment was insured against loss or damage in transit.

A Letter of Credit commercial instrument through which a bank or other financial institution instructs a correspondent institution to advance a specified sum of money to the bearer. The document is called a circular letter of credit when it is not addressed to any particular correspondent. In effect, a letter of credit is a draft, save that the amount is merely stated as a maximum not to be exceeded. Letters of credit, mainly used by travellers, greatly simplify non-local business transactions.

Those who issue such letters are usually so well known that any bank will honour the letter upon proper identification. Traveller's checks are a modified form of a letter of credit. They are issued in coupons, upon whose face a value is usually expressed in terms of the currency of a particular country. In the US they are issued by express companies and banks. Circular letters of credit require that each payment, as it is made, be endorsed by the firm making payment so that other banks may know how much of the total credit has been used.

However, the list and form of documents is open to imagination and negotiation and might contain requirements to present documents issued by a neutral third party evidencing the quality of the goods shipped, or their place of origin.

Letters of Credit types:

- Revocable letter of credit - can be revoked by the Issuing Bank without the agreement of the beneficiary.

- Irrevocable letter of credit - can not be cancelled or amended without all the parties agreement.

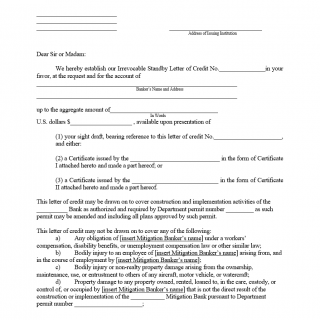

- Standby letter of credit or Guarantee of payment. If the beneficiary does not get paid from it's customer it can then demand payment from the Bank by forwarding the copy of the invoice that was not paid and supporting documentation.

- Revolving letter of credit - is established when there are regular shipments of the same commodity between supplier and customer. Eliminates the need to issue an letter of credit for each transaction

In international trade, if the buyer pays in advance, he risks that the goods may not be sent. Similarly, if the seller ships the goods before he receives full payment from the buyer, he risks not being paid. To cover these risks, buyers, sellers, and banks use documentary letters of credit in international trade transactions. Under this method, the supplier requires these documents to be presented before payment is made.

Essentially, a letter of credit adds a bank's promise of paying the exporter to that of the foreign buyer once the exporter has complied with all of the terms and conditions of the letter of credit. The foreign buyer or "applicant" applies for issuance of a letter of credit to the exporter or "beneficiary."

Banks charge fees, usually a small percentage of the amount of payment, for handling letters of credit. They also charge fees for any amendment made to the letter of credit after it has been issued. All quotations and drafts should explicitly state that fees are to be charged to the buyer's account, since the buyer generally incurs all fees.

All terms of sale should be clearly specified, since payment is made according to the document's contents. For example, "net 30 days" should be specified as "net 30 days from acceptance" or "net 30 days from date of bill of lading" to avoid confusion and delay of payment. Likewise, the currency of payment should be specified as "US $xxx" if payment is to be made in U.S. dollars. International bankers can offer other helpful suggestions.

An exporter usually does not receive payment until the advising or confirming bank receives the funds from the issuing bank. To expedite the receipt of funds, wire transfers may be used. However, for an additional charge, the exporter may be able to receive funds immediately by discounting the letter of credit at the bank. Exporters should consult with their international bankers about the bank policy towards letters of credit.

Each documentary letter of credit must contain the following information:

- Expiration date (latest shipping date)

- Dollar amount covered under such credit

- Name and address of buyer (applicant)

- Name and address of seller (beneficiary)

- Reimbursing instructions

Also, the most common documents required under commercial letters of credit are:

- Commercial Invoice

- Customs Invoice

- Certificate of Origin

- Packing List

- Clean on Board Bills of Lading

- Insurance Policy or Certificate

- Airway Bill