Pay for Delete Letter

A Pay for Delete Letter is a form used in the process of credit repair. This letter is sent to a creditor or collection agency requesting that they remove a negative item from a credit report in exchange for payment. The main purpose of this form is to negotiate the removal of derogatory information from a credit report, which can improve an individual's credit score and overall financial standing.

The form typically consists of a letter addressed to the creditor or collection agency, explaining the situation and requesting that the negative item be removed from the credit report. The letter should include the individual's name, address, and account information, as well as the amount of money being offered in exchange for the removal of the negative item. It is important to consider the language and tone used in the letter, as it can impact the success of the negotiation.

When completing the form, individuals will need to provide their personal information, as well as information about the creditor or collection agency and the negative item being disputed. It may be helpful to attach any relevant documentation, such as proof of payment or correspondence with the creditor or collection agency.

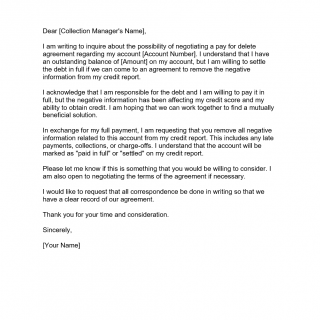

Sample of Payment for Delete Letter

Dear [Collection Manager's Name],

I am writing to inquire about the possibility of negotiating a pay for delete agreement regarding my account [Account Number]. I understand that I have an outstanding balance of [Amount] on my account, but I am willing to settle the debt in full if we can come to an agreement to remove the negative information from my credit report.

I acknowledge that I am responsible for the debt and I am willing to pay it in full, but the negative information has been affecting my credit score and my ability to obtain credit. I am hoping that we can work together to find a mutually beneficial solution.

In exchange for my full payment, I am requesting that you remove all negative information related to this account from my credit report. This includes any late payments, collections, or charge-offs. I understand that the account will be marked as "paid in full" or "settled" on my credit report.

Please let me know if this is something that you would be willing to consider. I am also open to negotiating the terms of the agreement if necessary.

I would like to request that all correspondence be done in writing so that we have a clear record of our agreement.

Thank you for your time and consideration.

Sincerely,

[Your Name]

An example of when this form may be used is if an individual has a past due account that has been sent to collections. They can negotiate with the collection agency to remove the negative item from their credit report in exchange for payment.

Strengths of this form include the potential to improve an individual's credit score and financial standing, while weaknesses may include the possibility of the creditor or collection agency not agreeing to the terms of the negotiation. Opportunities include the potential for improved credit and financial opportunities, while threats may include the possibility of damaging credit and financial consequences if the negotiation is unsuccessful.

An alternative form to a Payment for Delete Letter may be a dispute letter, which is used to challenge inaccurate or incomplete information on a credit report. The main difference between the two forms is that a Pay for Delete Letter is used to negotiate the removal of accurate negative information, while a dispute letter is used to challenge inaccurate information.

To fill and submit the form, individuals should follow the instructions provided by the creditor or collection agency. The form should be stored in a safe place for future reference.