Goodwill Letter

A Goodwill Letter is a written request to a creditor or lender to remove a negative item from a credit report. The main purpose of a Goodwill Letter is to request leniency from the creditor or lender and ask them to remove a negative item that may be harming an individual's credit score.

A Goodwill Letter typically consists of several parts, including a brief description of the situation, an explanation of the negative item on the credit report, and a request for the creditor or lender to remove the negative item as an act of goodwill.

The parties involved in a Goodwill Letter are the individual requesting the removal of the negative item and the creditor or lender who reported the negative item to the credit bureau. It is important to consider the reason for the negative item and whether it was due to a one-time mistake or a pattern of behavior.

When filling out a Goodwill Letter, important fields include the name and contact information of the individual and the creditor or lender, a description of the negative item on the credit report, and a request for the removal of the negative item. Additional documents that may need to be attached include any documentation that supports the individual's request for leniency, such as proof of a one-time mistake or extenuating circumstances.

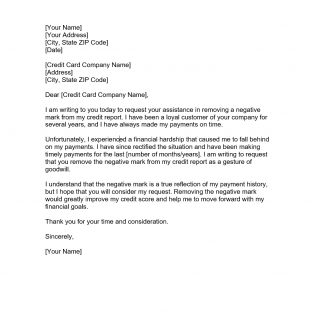

Sample of letter

Dear [Credit Card Company Name],

I am writing to you today to request your assistance in removing a negative mark from my credit report. I have been a loyal customer of your company for several years, and I have always made my payments on time.

Unfortunately, I experienced a financial hardship that caused me to fall behind on my payments. I have since rectified the situation and have been making timely payments for the last [number of months/years]. I am writing to request that you remove the negative mark from my credit report as a gesture of goodwill.

I understand that the negative mark is a true reflection of my payment history, but I hope that you will consider my request. Removing the negative mark would greatly improve my credit score and help me to move forward with my financial goals.

Thank you for your time and consideration.

Sincerely,

[Your Name]

Application examples of a Goodwill Letter include when an individual has missed a payment or defaulted on a loan, resulting in a negative item on their credit report. By writing a Goodwill Letter, the individual can request that the negative item be removed, potentially improving their credit score and making it easier to obtain credit in the future.

Strengths of a Goodwill Letter include the potential to improve an individual's credit score and make it easier to obtain credit in the future. Weaknesses may include the potential for the creditor or lender to refuse the request and the need for accurate and complete information to support the request.

Alternative forms to a Goodwill Letter may include a credit report dispute form or a debt validation letter. The main difference between these forms is the type of negative item being addressed. A credit report dispute form is used to dispute inaccurate information on a credit report, while a debt validation letter is used to request validation of a debt.

To fill out and submit a Goodwill Letter, it is recommended to work with a credit counselor or financial advisor who is experienced in writing such letters. The completed letter and any attached documentation should be stored securely, as they contain sensitive financial information.