Debt Validation Letter

A debt validation letter is a written request sent by a debtor to a creditor or collection agency asking for proof of the validity of a debt. The main purpose of this letter is to ensure that the debtor is not being wrongly pursued for a debt they don't owe or a debt that has already been paid off.

The letter typically consists of several parts, including the debtor's contact information, the creditor's or collection agency's contact information, a statement requesting validation of the debt, and a request for copies of all relevant documents related to the debt.

When compiling or filling out the form, it is important to consider including as much detail as possible about the debt in question, including the original creditor, the amount owed, and any relevant dates or account numbers. It may also be helpful to attach any supporting documentation, such as receipts or payment records.

Examples of when a debt validation letter may be necessary include cases where a debtor has been contacted by a collection agency for a debt they don't recognize, or cases where a debtor believes they have already paid off a debt but are still being pursued for payment.

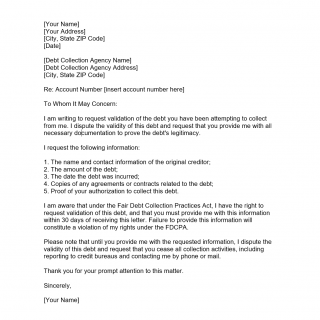

Sample of Debt Validation Letter

[Debt Collection Agency Name]

[Debt Collection Agency Address]

[City, State ZIP Code]Re: Account Number [insert account number here]

To Whom It May Concern:

I am writing to request validation of the debt you have been attempting to collect from me. I dispute the validity of this debt and request that you provide me with all necessary documentation to prove the debt's legitimacy.

I request the following information:

1. The name and contact information of the original creditor;

2. The amount of the debt;

3. The date the debt was incurred;

4. Copies of any agreements or contracts related to the debt;

5. Proof of your authorization to collect this debt.I am aware that under the Fair Debt Collection Practices Act, I have the right to request validation of this debt, and that you must provide me with this information within 30 days of receiving this letter. Failure to provide this information will constitute a violation of my rights under the FDCPA.

Please note that until you provide me with the requested information, I dispute the validity of this debt and request that you cease all collection activities, including reporting to credit bureaus and contacting me by phone or mail.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Strengths of this form include its ability to protect debtors from unfair or fraudulent debt collection practices, while weaknesses may include the potential for delays in resolving disputes and the possibility of additional fees or legal action.

Alternative forms or analogues to a debt validation letter may include debt dispute forms or credit report dispute forms, which serve a similar purpose of disputing inaccurate or fraudulent debt claims.

Submitting the form typically involves sending it via certified mail to the creditor or collection agency in question. It is important to keep a copy of the letter and any attached documentation for future reference.

Overall, the debt validation letter can play an important role in protecting debtors from unfair debt collection practices and ensuring the accuracy of debt claims.