Form N-20. Partnership Return of Income

The N-20 Partnership Return of Income is a form used by partnerships in the state of Hawaii to report their income and other financial information to the Hawaii Department of Taxation. The main purpose of the form is to calculate the partnership's taxable income and determine the amount of tax owed to the state.

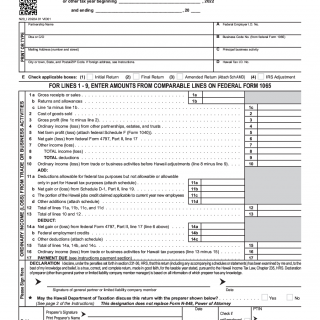

The form consists of several parts, including the partnership information section, income and deductions section, and tax computation section. Important fields include the partnership's name, address, and taxpayer identification number, as well as the total income and deductions for the partnership.

The parties involved in the process of filing the N-20 form include the partnership and the Hawaii Department of Taxation. It is important to consider deadlines when compiling the form, as there are specific due dates for filing the form and paying any taxes owed.

Data required to compile the form includes the partnership's income and deductions for the tax year, as well as any necessary supporting documents such as schedules and forms. Additionally, the partnership may need to attach a copy of the federal partnership tax return.

Application examples and use cases for the N-20 form include partnerships in Hawaii that need to report their income and pay taxes owed to the state. Benefits of filing the form include being in compliance with Hawaii tax laws and avoiding penalties for late or incorrect filings. Challenges and risks include potential errors in calculating taxable income and the possibility of being audited by the Hawaii Department of Taxation.

Related and alternative forms include the N-35 form, which is used for individual income tax returns in Hawaii, and the N-40 form, which is used for fiduciary income tax returns in Hawaii. The main difference between these forms is their purpose and the types of income and deductions reported.

Filing the N-20 form can affect the future of the partnership, as it ensures that the partnership is in compliance with Hawaii tax laws and avoids potential penalties for noncompliance. The form is submitted to the Hawaii Department of Taxation and is stored as part of the partnership's tax records.