Tax Power of Attorney and Declaration of Representative

A Tax Power of Attorney form, also known as a Tax POA, is a legal document that authorizes an individual, known as the "Agent," to act on behalf of another individual, known as the "Principal," for all tax-related matters.

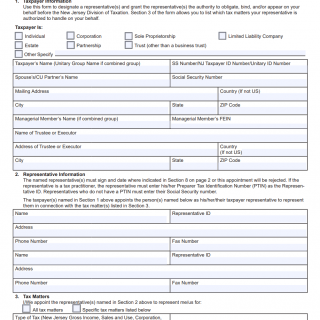

The form consists of several parts, which include:

- Taxpayer Information: This section requires the name, address, and taxpayer identification number of the Principal.

- Representative Information: This section requires the Agent's name, address, and taxpayer identification number.

- Tax Matters: This section specifies the type of tax matters that the Agent is authorized to handle, which may include filing tax returns, responding to correspondence from the IRS, or negotiating a tax settlement.

- Duration: This section outlines the length of time that the Tax POA will remain in effect.

- Signature: This section must be signed and dated by both the Principal and the Agent to make the document legally binding.

A Tax Power of Attorney form is drawn up in situations where an individual is unable or unwilling to handle their tax affairs themselves, and so they grant their Agent or representative the authority to act on their behalf. The parties involved in this process are the Principal and the Agent.

When compiling a Tax POA form, it is important to ensure that both parties are fully aware of the risks and obligations involved. The form should clearly state the specific tax matters that the Agent is authorized to handle, and the Agent should only act within the specific scope outlined in the document. The form must also be signed and dated by both the Principal and the Agent.

The advantages of using a Tax Power of Attorney include reduced stress and peace of mind for the Principal, as they can delegate the responsibility for their tax affairs to someone they trust. Additionally, it can help to ensure that tax obligations are timely and accurately met. However, if the form is filled out incorrectly or without proper understanding, it can lead to problems, such as legal or financial consequences for the Principal.

In summary, a Tax Power of Attorney form is a useful legal document that grants another individual or representative the authority to act on an individual's behalf for tax-related matters. It is important to take great care when preparing this document to ensure that both parties understand their respective rights, obligations, and the scope of the authority granted by the document.