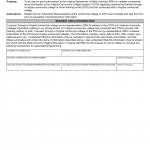

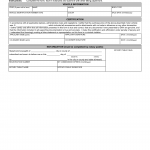

Form TPT 500. Third-party Tester Program CDL Examiner's Roadtest Tablet Application - Virginia

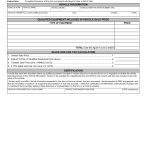

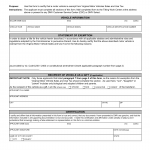

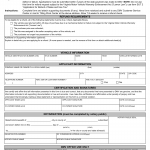

Form TPT 500 - Third-Party Tester Program CDL Examiner's Roadtest Tablet Application serves as an application for Third-Party Testers to request one or more CDL Examiner Roadtest Tablets from the Virginia Department of Motor Vehicles.

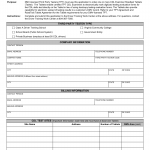

The parties involved are the Third-Party Testers and the Virginia Department of Motor Vehicles. The form is composed of sections detailing the tablet request, user information, and necessary signatures.