Form SUT 3. Purchaser's Statement of Tax Exemption - Virginia

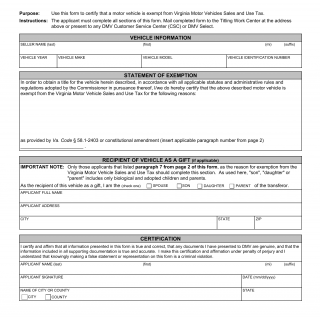

Form SUT 3 - Purchaser's Statement of Tax Exemption serves as a certification tool for declaring that a motor vehicle is eligible for exemption from Virginia Motor Vehicles Sales and Use Tax. It facilitates the process of exempting certain vehicles from the tax requirement.

This form involves two parties: the purchaser of the vehicle and the Virginia Department of Motor Vehicles. The form includes sections for providing purchaser details, vehicle information, and a declaration of the specific exemption reason.

Important fields in this form include purchaser's name, address, vehicle identification number (VIN), description of the exemption reason, and signature. It's crucial to ensure accurate information and proper documentation to justify the exemption.

For instance, if an individual is purchasing a vehicle for use in a tax-exempt organization, like a charitable nonprofit, they would complete this form to declare the exemption status, ensuring compliance with tax regulations while avoiding unnecessary tax payments.

No additional related forms are mentioned in the description. However, an alternative could be an exemption application process through an online portal or a different tax exemption form for other types of exemptions.