Form SUT 2A. Refund of Sales and Use Tax Application and Affidavit - Virginia

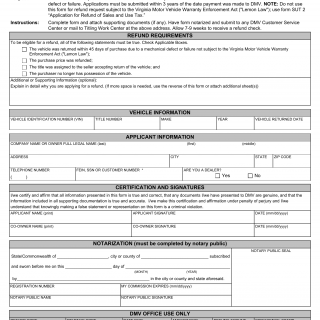

Form SUT 2A - Refund of Sales and Use Tax Application and Affidavit is used to request a refund of Sales and Use Tax paid to the DMV for a vehicle that was returned to the seller due to a mechanical defect or failure. This form is essential for individuals who need to obtain a refund for taxes paid on a vehicle that had to be returned due to a defect.

The parties involved are the individual requesting the refund and the Virginia Department of Motor Vehicles. The form includes sections for applicant details, vehicle information, explanation of the return, and supporting documentation.

Important fields in this form include applicant information, vehicle details, explanation of the return, and any necessary supporting documentation. Providing accurate information about the vehicle return and the reasons behind it is essential for processing the refund.

An example use case is an individual who purchased a vehicle but had to return it to the seller due to a mechanical failure. This form enables them to request a refund for the Sales and Use Tax paid for the returned vehicle.

Applicants should provide any relevant supporting documents that prove the return of the vehicle and its mechanical defect. Related forms might involve requests for refunds for other fees or taxes paid to the DMV in specific circumstances.