Form RDT 121I. IFTA Quarterly Tax Return Instructions - Virginia

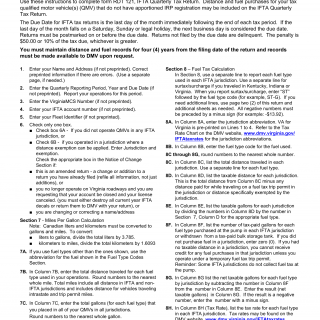

Form RDT 121I - IFTA Quarterly Tax Return Instructions provides guidance on completing Form RDT 121, the IFTA Quarterly Tax Report. It assists carriers in accurately reporting mileage and fuel purchases for tax-qualified vehicles that lack apportioned International Registration Plan (IRP) registration.

The parties involved are the IFTA carriers and the Virginia Department of Motor Vehicles. The instructions provide step-by-step guidance for filling out Form RDT 121 accurately.

Key information in these instructions includes guidelines for calculating mileage and fuel purchases for tax-qualified vehicles, especially those lacking apportioned IRP registration. Accurate reporting ensures compliance with IFTA regulations.

An example scenario is a carrier operating a vehicle without apportioned IRP registration. The instructions help the carrier accurately report mileage and fuel consumption for that vehicle on their IFTA Quarterly Tax Report.

No additional documents are typically required for these instructions. However, carriers should use them in conjunction with Form RDT 121 for accurate reporting. Related forms might include applications for specific IFTA decals or tax-related documents.