Form RDT 121. IFTA Quarterly Tax Report - Virginia

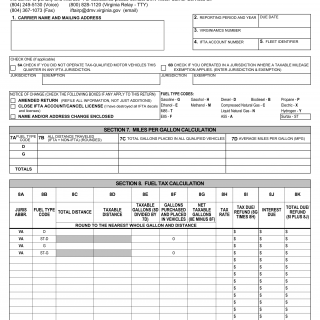

Form RDT 121 - IFTA Quarterly Tax Report is used by IFTA carriers to complete and submit the required quarterly tax report for fuel consumption and mileage. This form is crucial for carriers to comply with IFTA requirements and accurately report their fuel tax obligations.

The parties involved are the IFTA carrier and the Virginia Department of Motor Vehicles. The form includes sections for carrier details, mileage information, fuel consumption, and tax calculations.

Key fields include carrier information, distance traveled, fuel consumed, and tax calculations. Accurate reporting of mileage and fuel consumption is essential for calculating the correct fuel tax obligations.

An example use case is a trucking company submitting their quarterly fuel tax report to the Virginia DMV. This form enables carriers to fulfill their tax reporting obligations accurately and maintain compliance with IFTA regulations.

No additional documents are typically needed for this form. However, maintaining accurate records of mileage and fuel consumption is important. Related forms might involve tax exemption applications or documentation for specific types of vehicles.