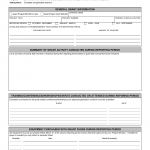

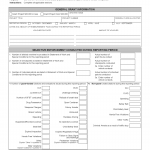

Form TSS 16A. Grant File Review Site Visit - Virginia

Form TSS 16A - Grant File Review Site Visit is used to conduct file reviews and site visits for grants. This form assists in documenting findings, discrepancies, and best practices identified during the review process.

The parties involved include grant recipients, grant funding agencies, and the Virginia Department of Motor Vehicles. The form sections encompass review details, findings, discrepancies, best practices, and documentation of the site visit.