Form SUT 5. Certification of Sale Price for Vehicle Purchased with Qualified Equipment - Virginia

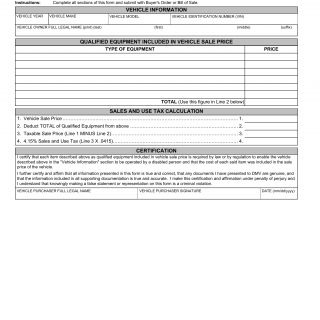

Form SUT 5 - Certification of Sale Price for Vehicle Purchased with Qualified Equipment enables individuals to calculate Sales and Use Tax when the purchase price of a vehicle includes the cost of qualified equipment required by law for handicapped accessibility.

This form involves the vehicle purchaser and the Virginia Department of Motor Vehicles. Sections within the form cover vehicle and equipment details, purchase price allocation, and tax calculation.

The important fields in this form encompass vehicle information, breakdown of equipment costs, sale price allocation, and tax calculation section. Accuracy in allocating the proper amounts to equipment costs and sale price is crucial for correct tax calculation.

For instance, if an individual purchases a vehicle with specialized equipment like wheelchair ramps, they would use this form to ensure proper tax assessment based on the vehicle's total value and the qualified equipment costs.

Related forms might include general sales tax exemption forms or forms for vehicle modifications that don't fall under handicapped accessibility requirements.