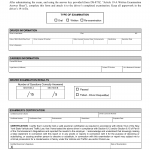

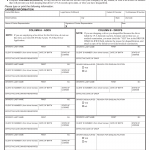

NYS DMV Form DS-875. Article 19-A Biennial Behind the Wheel Road Test

Article 19-A Biennial Behind the Wheel Road Test is a form used by the New York State Department of Motor Vehicles (DMV) to conduct a behind-the-wheel road test for drivers subject to Article 19-A regulations.

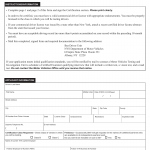

NYS DMV Form DS-875Q. Article 19-A Biennial Oral/Written Examination

Article 19-A Biennial Oral/Written Examination is a form issued by the New York State Department of Motor Vehicles (DMV) to evaluate drivers' knowledge and understanding of relevant regulations.

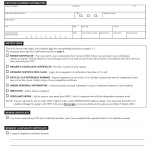

NYS DMV Form DS-875X. Instructions to Certified Examiner for Conducting Article 19-A Biennial Examinations

Form NYS DMV DS-875X provides instructions to certified examiners in New York State for conducting biennial examinations as part of Article 19-A requirements.

NYS DMV Form DS-875Y. Article 19-A Oral/Written Examination Results

Form NYS DMV DS-875Y is used to record and report the results of Article 19-A oral/written examinations conducted in New York State.

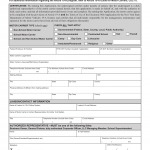

NYS DMV Form DS-876. Application for Article 19-A Certified Examiner

Form NYS DMV DS-876 is used to apply for certification as an Article 19-A examiner in New York State.

NYS DMV Form DS-877. Article 19-A Certified Examiner Application for Renewal or Amendment

Form NYS DMV DS-877 is used to renew or amend the certification of an Article 19-A examiner in New York State. This form is specifically designed for certified examiners who need to renew their certification or make changes to their existing certification information.

NYS DMV Form DS-879. Article 19-A Carrier Application

Form NYS DMV DS-879 is used by carriers in New York State to apply for Article 19-A compliance. This form is intended for employers or companies that employ commercial driver's license (CDL) drivers in positions requiring the operation of commercial motor vehicles.

NYS DMV Form DS-885. Article 19-A Bus Driver Add/Drop Notice

Form NYS DMV DS-885 is used to notify the New York State Department of Motor Vehicles about additions or removals of bus drivers under Article 19-A regulations.

NYS DMV Form DS-885CE. Article 19-A Add/Drop Notice Certified Examiner (CE)

NYS DMV Form DS-885CE is used by carriers in New York State to add or drop certified examiners under Article 19-A regulations. This form allows carriers to manage their roster of certified examiners by adding or removing individuals as needed.

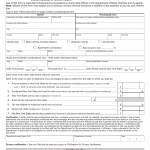

NYS DMV Form DTF-804. Statement of Transaction – Claim for Credit of Sales Tax Paid to Another State For Motor Vehicle, Trailer, All Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile (at NY State Department of Tax & Finance)

NYS DMV Form DTF-804 is used when a New York resident purchases a vehicle out-of-state, registers the vehicle in New York State, and applies for credit for the sales tax paid in the other state.