Form 540 2EZ. California Resident Income Tax Return

The Form 540 2EZ is a California Resident Income Tax Return form used to file state income taxes. This form is specifically designed for those taxpayers who have simple tax situations and do not require itemized deductions. The main purpose of this form is to report taxable income earned by residents of California and calculate the amount of state income tax owed or refundable.

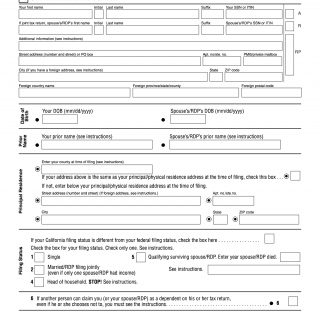

The form consists of several parts, including personal information, income, adjustments, California income tax, payments, and credits. Important fields on the form include the taxpayer's name, Social Security number, filing status, income sources, adjustments to income, and tax due or refundable. It is important to consider accurately filling out all information to avoid any errors or delay in processing the return.

Parties involved in this form include the taxpayer and the California Franchise Tax Board. When filling out the form, taxpayers will need their W-2 forms, 1099 forms, and other documents showing income earned during the tax year. Additional documents required may include Schedule CA (540) to report adjustments to income, and any necessary payment vouchers or estimated tax payments.

An example of when to use this form is if a taxpayer was a California resident for the entire tax year, had a total income of less than $100,000, and did not claim itemized deductions. A strength of this form is that it is easy to understand and complete, making it ideal for those with simple tax situations. A weakness of this form is that it cannot be used by all taxpayers, such as those who need to itemize deductions.

Alternative forms include Form 540 and Form 540NR for nonresidents or part-year residents. The difference between these forms is based on residency status and the ability to itemize deductions. Filing this form can affect the future of the taxpayer by ensuring timely and accurate reporting of income and avoiding penalties or interest charges.

The completed form can be submitted electronically or by mail to the California Franchise Tax Board. It is important to keep a copy of the completed form for your records.