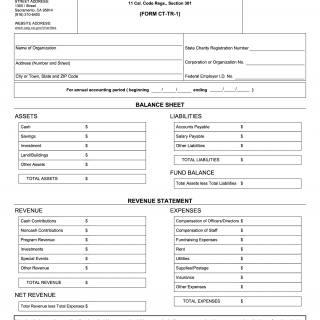

Form CT-TR-1. Annual Treasurer's Report to the Attorney General of California

The CT-TR-1 form is an important document required by the Attorney General of California, which serves as the Annual Treasurer's Report. The main purpose of this form is to provide financial information about an organization's activities over the course of a year.

This form consists of several parts, including general information about the organization, a statement of receipts and disbursements, an itemized schedule of assets and liabilities, and additional disclosures regarding the organization's financial practices. It is important to consider that accuracy and honesty are crucial when filling out this form, as it will be reviewed by the Attorney General's office.

Some of the important fields on this form include the organization's name, address, and tax identification number, as well as detailed information about the organization's income and expenses. Additionally, there may be additional documents that need to be attached, such as bank statements or other financial records.

Examples of when this form might be necessary include for nonprofit organizations, political action committees, or other groups that engage in fundraising activities and want to maintain transparency and compliance with state regulations.

Strengths of this form include the ability to provide stakeholders with a clear picture of an organization's financial health, while weaknesses may include the time and effort required to compile all of the necessary information. Opportunities may include the possibility of identifying areas for improvement in an organization's financial practices, while threats may include potential penalties for noncompliance.

Related forms may include other financial reporting requirements mandated by the state of California or the federal government. Analogues to this form might include similar financial reporting requirements in other states or countries. The key difference with other forms will depend on the specific reporting requirements, but generally relates to the purpose and scope of the information being reported.

Submitting the CT-TR-1 form can be done online or by mail, and the form will be stored by the Attorney General's office for future reference. Filling out this form can have a significant impact on an organization's reputation and future financial prospects, making it an important document to be taken seriously.