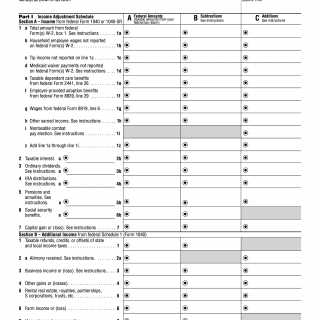

Form 540 Schedule CA. California Adjustments - Residents

Form 540 Schedule CA is a tax form used by California residents to report adjustments made to their income and tax liability. The purpose of this form is to calculate the taxpayer's California taxable income, which is different from their federal taxable income, and determine their California tax liability.

The form consists of various sections that require taxpayers to report certain adjustments to income, deductions, and credits. These adjustments may include items such as state and local taxes, mortgage interest, charitable contributions, and other expenses.

Some important fields on the form include the taxpayer's name, Social Security number, and filing status. It is also essential for taxpayers to provide all necessary documentation to support their claimed adjustments, such as receipts or statements.

This form is relevant for California residents who are required to file a state tax return. It is important to note that failure to file this form accurately could result in penalties and interest charges.

One strength of Form 540 Schedule CA is that it allows taxpayers to claim adjustments that may reduce their California taxable income and resulting tax liability. However, a weakness of the form is that it can be complicated and time-consuming to fill out correctly.

Related forms may include Form 540, California Resident Income Tax Return, and Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Analogues could include similar state tax forms from other states.

Submitting the form can be done electronically or through traditional mail, and it is stored by the California Franchise Tax Board.

In conclusion, Form 540 Schedule CA is an essential tax form for California residents who need to file their state tax returns. Accurately reporting and calculating adjustments on this form will ensure compliance with California tax laws and potentially reduce tax liability.