Form RRF-1 form is an Annual Registration Renewal Fee Report to Attorney General of California

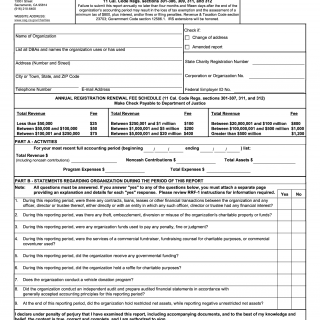

The RRF-1 form is an Annual Registration Renewal Fee Report that must be submitted to the Attorney General of California by charitable organizations registered with the state. Charitable organizations must file this form each year in order to maintain their registration and continue to solicit donations from the public.

The RRF-1 form consists of several parts including basic information about the organization such as its name, address, and contact information. It also requires details about the organization's income and expenses, assets and liabilities, and program services provided during the reporting period. Nonprofit organizations are required to attach additional documents such as financial statements and disclosures about any fundraising campaigns or activities conducted during the reporting period.

This form is important for both charitable organizations and donors as it ensures transparency in the nonprofit sector and helps prevent fraudulent activity. Failure to submit the RRF-1 form can result in penalties and revocation of the organization's registration.

When filling out this form, it is important to carefully review all instructions and provide accurate and complete information. Some important fields include the organization's gross receipts, net assets, and compensation paid to key employees.

Strengths of the RRF-1 form include its ability to promote transparency and accountability in the nonprofit sector, while weaknesses include the potential burden on smaller nonprofits to comply with reporting requirements. Opportunities for improvement may include simplifying the reporting process or providing more resources for organizations to navigate the requirements.

Related forms may include the Form 990 for tax-exempt organizations or state-specific forms for registration or annual reporting. Analogues to the RRF-1 form may include similar requirements in other states or countries.

Submitting the RRF-1 form and maintaining compliance with reporting requirements can affect the future of the organization by preserving its reputation and ability to receive donations from the public. The form can be submitted electronically or by mail, and is stored by the Attorney General's office for public access.