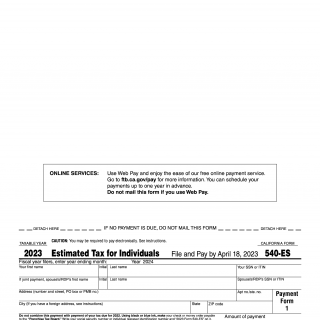

Form 540-ES. Estimated Tax for Individuals

Form 540-ES is a tax form used by individuals in the United States to estimate their income tax liability for the year and pay their estimated taxes on a quarterly basis. The purpose of this form is to help taxpayers avoid underpayment penalties by making timely and accurate payments throughout the year.

The form consists of several parts including personal information, estimated tax calculations, payment vouchers, and instructions for completion. Important fields include gross income, deductions, credits, and estimated tax payments made during the year.

Individuals who are required to pay estimated taxes include self-employed individuals, freelancers, and those with significant investment income. It is important to consider factors such as changes in income or deductions when filling out this form to ensure accurate estimation.

When filling out the form, taxpayers will need to provide information about their income, deductions, and tax payments made throughout the year. In addition, they may be required to attach additional documents such as schedules and worksheets to support their calculations.

Examples of situations where Form 540-ES may be needed include starting a new business, experiencing a significant increase in income, or receiving income from multiple sources that are not subject to withholding.

Strengths of using Form 540-ES include avoiding underpayment penalties and ensuring accurate estimation of tax liabilities. Weaknesses may include the complexity of the form and the potential for errors in calculation.

Alternative forms include Form W-4 for employees who want to adjust their withholding and Form 1040-ES for individuals who do not have income tax withheld from their wages or who have income from sources other than wages.

The submission of Form 540-ES and payment of estimated taxes can be done electronically or via mail, and the form should be retained for at least three years after the due date of the return.

Overall, Form 540-ES plays an important role in helping individuals accurately estimate and pay their income taxes throughout the year, alleviating the burden of a large tax payment at year-end.