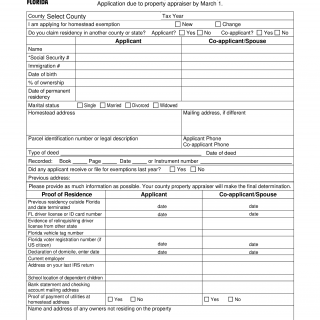

Form DR-501. Original Application for Homestead and Related Tax Exemptions

The DR-501 form is an Original Application for Homestead and Related Tax Exemptions in Florida. The main purpose of this form is to allow homeowners to apply for various property tax exemptions and benefits available to them. These include the Homestead Exemption, additional exemptions for seniors, veterans, and disabled individuals, as well as exemptions for specific types of properties such as historic or environmentally sensitive ones.

The DR-501 form consists of several parts that need to be filled out accurately and completely. It includes sections for personal information, property details, exemption claims, and signature and oath statements. Important fields to consider when filling out this form include the applicant's name, address, Social Security number, and property ownership information. In addition, applicants must provide evidence of their eligibility for the requested exemptions, such as proof of age, disability, or military service.

This form is important for homeowners who want to reduce their property taxes and save money. By claiming eligible exemptions, they can receive significant reductions in their tax bills and improve their financial stability. However, it is essential to fill out the DR-501 form correctly and attach all necessary documents to avoid delays or rejections.

Strengths of the DR-501 form include clear instructions and guidelines provided by the Florida Department of Revenue, which make it easier for applicants to understand the process and requirements. One potential weakness is the complexity of some exemption categories, which may require additional research and documentation.

Alternative forms or analogues of the DR-501 form may exist in other states or jurisdictions with different eligibility criteria and procedures. Homeowners should review these options carefully and compare them to the DR-501 to determine which one offers the best value and benefits for their situation.

Submitting the DR-501 form can be done online, by mail, or in person at a local property appraiser's office. Once submitted, the form is stored in the property records of the county where the property is located and can be accessed by relevant authorities as needed.

Overall, the DR-501 form plays a crucial role in helping homeowners apply for property tax exemptions and benefits that can improve their financial situation and quality of life. By following the instructions and providing accurate information, applicants can increase their chances of success and gain peace of mind knowing they have taken advantage of all available options.