IRS Form 8822. Change of Address

IRS Form 8822 is used by individuals to notify the Internal Revenue Service of a change in their home mailing address. This form allows the IRS to update its records so that tax-related correspondence is sent to the correct address.

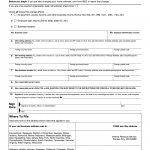

IRS Form 8822-B. Change of Address or Responsible Party

IRS Form 8822-B is used by businesses and organizations to notify the Internal Revenue Service of a change in business mailing address, business location, or responsible party. This form applies to entities that have an Employer Identification Number (EIN).

Schedule K-1 (Form 1065) Capital Account: What It Means

Schedule K-1 (Form 1065) includes a capital account section that tracks a partner’s investment in the partnership over time.

Schedule K-1 (Form 1065) for Foreign Partners

Schedule K-1 (Form 1065) is issued to foreign partners when a partnership has partners who are not U.S. persons for federal tax purposes.

What to Do If Schedule K-1 (Form 1065) Is Late

Schedule K-1 (Form 1065) is often issued later than other tax documents. This is a common situation and does not necessarily indicate a problem.

Do You Need to File If Schedule K-1 Shows No Income?

Schedule K-1 (Form 1065) may show zero income, a loss, or no cash distributions for a tax year. This situation is common and does not necessarily mean the form can be ignored.

Schedule K-1 vs Schedule K-3: What Is the Difference?

Schedule K-1 (Form 1065) and Schedule K-3 are related IRS forms, but they serve different purposes and report different types of information.

Schedule K-1 (Form 1065) for LLC Members

Schedule K-1 (Form 1065) is issued to members of an LLC when the LLC is treated as a partnership for federal tax purposes.

When Do You Receive Schedule K-1 (Form 1065)?

Schedule K-1 (Form 1065) is issued by a partnership to report each partner’s share of income, deductions, credits, and other tax items for the tax year.

Schedule K-1 (Form 1065): Official Overview Based on IRS Instructions

Schedule K-1 (Form 1065) is an IRS tax document used by partnerships to report each partner’s distributive share of income, deductions, credits, and other tax items for the tax year.