Life Changes That Affect Form W-4

Certain changes in an employee’s personal or financial situation can affect how federal income tax withholding is applied, making it necessary to update Form W-4. These changes alter the information used by an employer to apply withholding rules during payroll processing.

When Form W-4 Should Be Updated

Form W-4 should be updated when an employee’s withholding information no longer reflects their current situation and federal income tax withholding needs to be recalculated.

Form W-4 for a New Job

Form W-4 is required when an individual starts a new job as an employee and federal income tax withholding must be applied to wages. The form provides the employer with the information needed to begin withholding correctly from the first payroll payments.

Who Must Complete Form W-4

Form W-4 must be completed by individuals who are treated as employees for federal payroll tax purposes and receive wages subject to federal income tax withholding. The form provides employers with the withholding information required under federal tax law.

When Form W-4 Is Required

Form W-4 is required when an employee begins work with an employer and federal income tax withholding must be applied to wages. The form establishes the withholding information an employer needs in order to calculate federal income tax deductions from pay.

IRS Form W-4

IRS Form W-4 is used to provide an employer with information needed to determine how much federal income tax should be withheld from an employee’s wages.

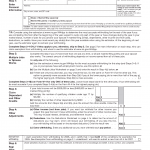

IRS Form W-4. Employee's Withholding Certificate

Form W-4, Employee’s Withholding Certificate, is an Internal Revenue Service document used by employees to provide their employer with information necessary to determine the amount of federal income tax to withhold from wages.

Where to Mail IRS Change of Address Forms

IRS change of address forms are filed by mail and must be sent to the correct IRS address to ensure proper processing. The mailing address depends on which form is being filed and, in some cases, on the taxpayer’s prior address.

How Long Does the IRS Take to Process a Change of Address?

When you file a change of address with the IRS, the update is not immediate. Both Form 8822 and Form 8822-B are processed manually, and it generally takes several weeks for address changes to be reflected in IRS records.

IRS Form 8822 for Estate and Gift Tax Returns

Form 8822 is used to notify the IRS of a change in home mailing address for matters related to estate, gift, or generation-skipping transfer tax returns. This ensures that IRS correspondence connected to these filings is sent to the correct address.