TX HHS Form 8666. Volunteer Orientation Agreement

Form 8666, titled Volunteer Orientation Agreement, is an internal compliance document used by organizations that engage volunteers, particularly in healthcare, social services, or community-based programs.

TX HHS Form H1019-F. Reporting Changes to Your Case

Form H1019-F is an official Texas Health and Human Services Commission (HHSC) document used to report changes to an existing benefits case. It applies to programs such as SNAP food benefits and other assistance administered through YourTexasBenefits.

Free Printable Basic Rental Agreement

This Free Printable Basic Rental Agreement is a simple and legally structured lease template designed for residential property rentals in the United States. It is ideal for landlords and tenants who need a clear, easy-to-use agreement without unnecessary legal complexity.

One Page Lease Agreement (Residential Rental)

A One Page Lease Agreement is a concise residential rental contract designed for situations where parties need a clear, legally structured lease without excessive clauses or complex legal language.

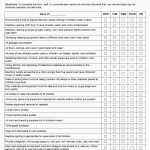

TX HHS Form 1100. Daily Building and Grounds Checklist

Form 1100, titled Daily Building and Grounds Checklist, is a practical compliance document used by childcare providers to record daily safety and sanitation checks of their facilities.

TX HHS Form H1134. Help Statement Verification

Form H1134, titled Help Statement Verification, is an official Texas Health and Human Services Commission (HHSC) document used to verify financial or non-financial assistance provided to a household applying for or receiving public benefits.

TX HHS Form 8203. Subcontractor Attestation Form

Form 8203 is an official attestation used in Texas within the Adult Mental Health E-Health and Community Based Services system.

TX HHS Form 3613-A. SNF. NF. ICF/IID. ALF. DAHS including ISS providers and PPECC Provider Investigation Report with Cover Sheet

Form 3613-A is an official Provider Investigation Report used in Texas to document and report incidents, allegations, and investigation findings involving individuals receiving care in regulated healthcare and long-term care settings.

TX HHS Form 2912. Pre-Employment Affidavit for Applicants for Employment at Certain Child Care Operations

Form 2912, titled Pre-Employment Affidavit for Applicants for Employment at Certain Child Care Operations, is a mandatory disclosure document used in Texas for individuals seeking employment in regulated child care settings.

TX HHS Form 1024. Individual Status Summary

Form 1024, titled Individual Status Summary, is an official Texas Health and Human Services document used to justify situations where an individual’s services exceed established cost limits under certain Medicaid waiver programs.