What Is a Substitute Form W-9?

A substitute Form W-9 is an alternative version of Form W-9 used by payers or requesters to collect the same taxpayer information required for U.S. tax reporting and withholding purposes.

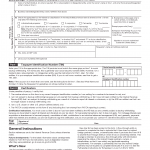

IRS Form W-9. Request for Taxpayer Identification Number and Certification

IRS Form W-9 is an official U.S. tax document used to request a taxpayer identification number (TIN) and a certification of U.S. taxpayer status. The form is issued by the Internal Revenue Service and is used for federal information reporting and withholding purposes.

Form W-9 for Independent Contractors

Independent contractors are commonly asked to provide Form W-9 as part of U.S. tax reporting and payment documentation. This page explains why Form W-9 is requested from independent contractors and how it is used in this context.

Who Needs to Provide Form W-9?

Form W-9 is provided by individuals and entities that are required to document their U.S. taxpayer status for federal tax reporting purposes. This page explains who typically needs to provide Form W-9 and in what contexts it is requested.

When Is Form W-9 Required?

Form W-9 is requested in specific situations where U.S. tax reporting or withholding rules apply to payments made to a U.S. person. This page explains when Form W-9 is typically required and why requesters ask for it.

Why Does Form W-9 Ask for an SSN or EIN?

Form W-9 requests a taxpayer identification number (TIN), which may be a Social Security number (SSN), an Employer Identification Number (EIN), or another valid TIN. This page explains why this information is required and how it is used in U.S. tax reporting.

Form W-9 vs Form W-8: What Is the Difference?

Form W-9 and Form W-8 are both used in U.S. tax reporting, but they serve different purposes and apply to different categories of taxpayers. Understanding the distinction is essential to determining which form applies in a given situation.

Backup Withholding and Form W-9 Explained

Backup withholding is a federal tax withholding mechanism that may apply when certain reporting requirements are not met. One of the most common triggers for backup withholding is the absence of a valid Form W-9.

Is It Safe to Provide Form W-9?

Form W-9 contains sensitive identifying information, including a taxpayer identification number (TIN). Because of this, many people question whether it is safe to provide the form when requested.

What Happens If You Don’t Provide Form W-9

Form W-9 is used to establish a payee’s U.S. taxpayer status and to provide a correct taxpayer identification number (TIN). When a completed Form W-9 is not provided, U.S. tax rules require the requester to apply specific presumption and withholding rules.