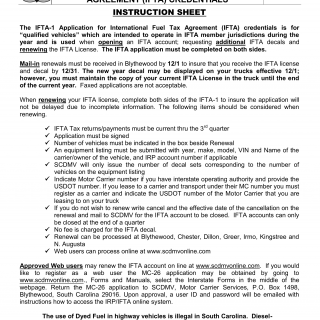

SCDMV Form IFTA-1. Application for International Fuel Tax Agreement (IFTA) Credentials

This form is used by individuals or businesses engaged in interstate motor carrier operations to apply for International Fuel Tax Agreement (IFTA) credentials. The form consists of personal or business information, vehicle details, and tax filing requirements. It is important to accurately provide all required information, including the names and addresses of the owners or operators, vehicle identification numbers (VINs), and distance and fuel records.

An application example for this form would be if a trucking company operates vehicles in multiple participating jurisdictions covered by the IFTA. By completing the IFTA-1 form, they can apply for the necessary credentials to report and pay fuel taxes based on their mileage traveled in each jurisdiction. This simplifies the reporting process and ensures compliance with tax regulations.

An alternative form that may be used in a similar scenario is the SCDMV Form IFTA-2. Base Jurisdiction Change Application. The IFTA-2 form is used when there is a change in the base jurisdiction for IFTA reporting, while the IFTA-1 is specifically for applying for IFTA credentials.