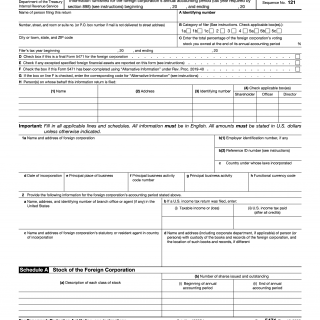

IRS Form 5471. Information Return of U.S. Persons With Respect To Certain Foreign Corporations

Form 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations, is one of the most important forms used for the purposes of foreign operations. This form provides the Internal Revenue Service (IRS) with important information about U.S. persons who are involved in foreign operations. The form applies to both individuals and companies and requires that the details of any foreign corporations controlled by the U.S. individual or company be reported.

The form consists of two main parts, Part I and Part II, and also contains Schedules F, E, D, C, and B. The information requested on this form includes details of the taxpayer’s ownership and transactions with the foreign corporation, interest and dividend income, the ownership of foreign partnership, and the activities of the foreign corporation.

All U.S. persons who are officers, shareholders, or directors of a foreign corporation, or who own more than a 10% interest in the stock of a corporation organized in a foreign country, must file this form. Additionally, a U.S. person who acquires stock in that foreign corporation which increases the person’s ownership to over 10% must file the form. Furthermore, any suspended passive foreign investment companies (PFICs) must file.

When filing this form, the taxpayer must attach required documents such as audited foreign financial statements, statements of operations, and balance sheets from each foreign corporation. The form should be completed accurately and in detail. It is important to note that failure to file the form properly and on time can result in significant penalties.

Form 5471 plays an important role in ensuring accurate tax reporting in the United States. It helps the IRS keep track of all foreign transactions and profits reported by U.S. taxpayers. Additionally, the form helps to ensure that all U.S. persons involved in foreign operations are properly complying with federal laws and regulations. Furthermore, this form is important for the purpose of collecting accurate data about the financial activities of U.S. persons with respect to foreign corporations. This data can then be used to properly assess taxes due and to ensure that no foreign income is left unreported.

Overall, Form 5471 is an important form for the purposes of taxation and for the purpose of keeping track of the financial activities and transactions of U.S. persons with respect to foreign corporations. The form is best filled by an experienced tax professional to ensure accuracy and completeness. The penalties for failure to file the form on time or to provide accurate information can be severe, so it is important to take the form seriously and to ensure that all information is provided accurately.